A Comprehensive Step-by-Step Guide to Becoming Your Own Bank Using Life Insurance

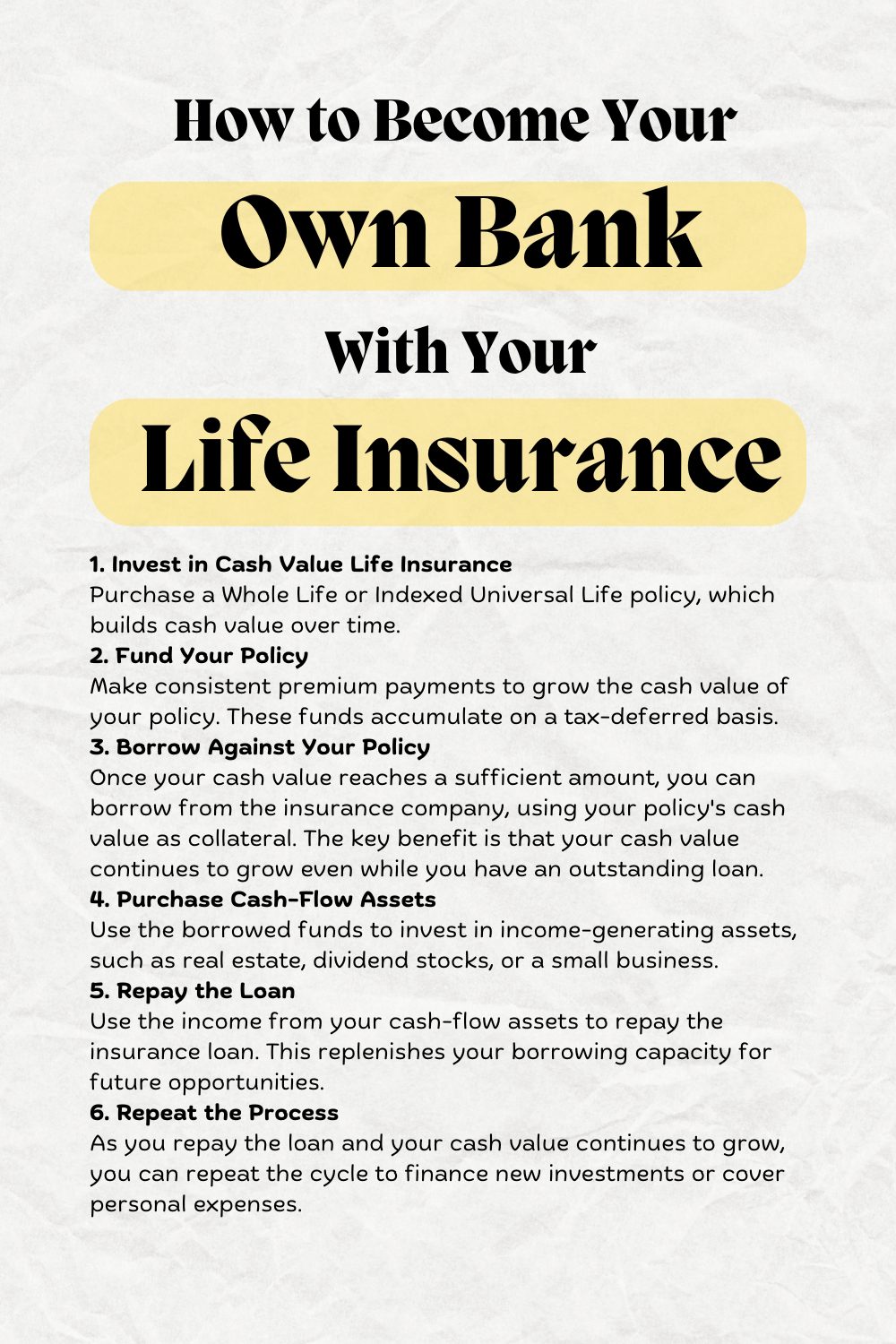

If you’ve ever wondered how to achieve financial independence and liquidity without relying on traditional banking systems, leveraging a cash-value life insurance policy can provide a powerful solution. Here’s a detailed step-by-step guide to help you become your own bank:

Step 1: Understand Cash Value Life Insurance

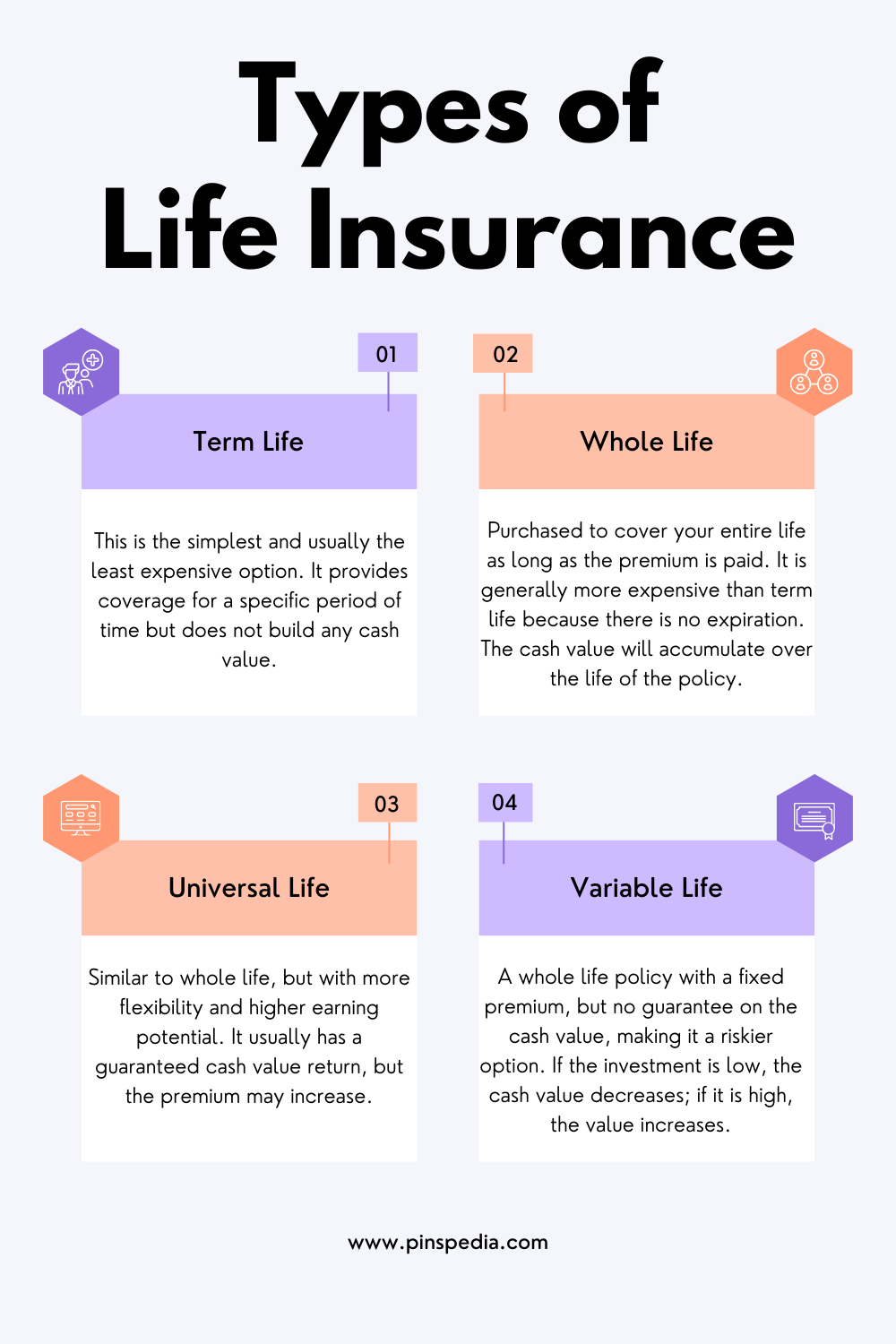

Cash-value life insurance policies, such as Whole Life Insurance or Indexed Universal Life Insurance (IUL), offer both a death benefit and a cash accumulation component. The cash value grows over time, making these policies ideal for building wealth while providing financial protection for your family.

Why Choose Cash-Value Life Insurance?

- Tax-Deferred Growth: The cash value grows without being taxed annually.

- Liquidity: You can borrow against the policy without credit checks.

- Flexibility: Use the funds for any purpose, from investments to personal expenses.

Step 2: Invest in the Right Policy

Work with a licensed insurance advisor to identify the best policy for your goals. Whole Life Insurance offers guaranteed growth and dividends, while IUL policies provide growth tied to market indices with downside protection.

Tips for Choosing a Policy:

- Look for policies with low fees and strong dividend histories (if choosing Whole Life).

- Ensure the policy is structured for maximum cash accumulation by minimizing death benefit costs.

- Understand the surrender charges and fees for early withdrawals or cancellations.

Step 3: Fund Your Policy

To build significant cash value, you’ll need to consistently fund your policy over time. Premium payments include costs for the death benefit and a portion allocated to the cash value account.

Best Practices for Funding:

- Contribute more than the minimum premium (up to the Modified Endowment Contract limits) to accelerate cash value growth.

- Make payments early to maximize compounding benefits.

- Consider “overfunding” policies to build cash value faster.

Step 4: Monitor Cash Value Growth

Track the performance of your policy over time. The cash value grows based on guaranteed returns, dividends (in Whole Life), or index performance (in IUL). Be patient, as it may take a few years before you accumulate sufficient cash value to borrow against.

Step 5: Borrow Against Your Policy

Once your cash value has grown to a sufficient level, you can borrow against it. The insurance company will lend you money using the cash value as collateral. This is a loan, not a withdrawal, so your cash value continues to grow uninterrupted.

Benefits of Borrowing:

- No Credit Checks: Loans are approved based on your policy’s cash value.

- Tax-Free Access: Borrowed funds are not considered taxable income.

- Uninterrupted Growth: The remaining cash value continues to earn dividends or interest.

Step 6: Invest in Cash-Flow Assets

Use the borrowed funds to purchase income-generating assets. This step is crucial to creating a self-sustaining financial system.

Examples of Cash-Flow Assets:

- Real Estate: Rental properties that provide monthly income.

- Dividend Stocks: Shares in companies that pay regular dividends.

- Small Businesses: Start or invest in businesses with steady revenue streams.

By investing in assets that generate income, you create a way to repay your loan while building wealth.

Step 7: Repay the Loan

Use the income from your investments to repay the loan. This replenishes your borrowing capacity and ensures the sustainability of your financial strategy.

Tips for Loan Repayment:

- Treat the loan like any other debt and set a repayment schedule.

- Pay interest promptly to avoid compounding debt.

- Consider repaying more than the minimum to rebuild cash value faster.

Step 8: Repeat the Process

As you repay the loan and your policy’s cash value continues to grow, you can repeat the process. This creates a cycle of borrowing, investing, and repayment that provides ongoing access to funds for new opportunities or personal needs.

Key Advantages of Becoming Your Own Bank

- Uninterrupted Growth: Your cash value keeps growing even while you borrow against it.

- Financial Control: Avoid traditional loan restrictions and credit requirements.

- Flexibility: Use borrowed funds for anything from investments to emergencies.

- Legacy Planning: The death benefit ensures your loved ones are financially secure.

FAQs and Tips for Success

How Long Does It Take to Build Sufficient Cash Value?

Typically, it takes 3–5 years of consistent funding to accumulate significant cash value, depending on how your policy is structured.

What Happens If I Don’t Repay the Loan?

Unpaid loans reduce your policy’s death benefit and cash value. Always have a repayment plan to maintain financial health.

Can I Use Multiple Policies?

Yes, you can use multiple policies to expand your borrowing capacity and diversify your investment strategy.

Conclusion

By leveraging cash-value life insurance, you can create a personal banking system that provides liquidity, financial security, and the ability to grow your wealth. With proper planning, this strategy empowers you to fund investments, achieve financial goals, and enjoy long-term financial freedom. Start by consulting with an expert to design the policy that aligns with your needs, and take control of your financial future today!