Becoming a Life Insurance Agent

There are only a small number of industries outside of the financial services industry that offer the potential for relatively inexperienced professionals to make significant income within their first year of employment. And within the financial services industry, few careers offer newcomers the opportunity to earn as much as a life insurance agent does right off the bat. In fact, a hard-working insurance agent can earn more than $100,000 in their first year of sales.

But success as an insurance agent doesn’t come without a cost. It’s a tough field, and most participants burn out sooner rather than later. Insurance agents hear the word “no” far more than they hear the word “yes.” It’s not uncommon for the word “no” to be delivered with a fair amount of obscenities and the proverbial door in the face. Additionally, many people hold insurance agents in low regard, with some equating them to glorified con artists. However, for those who can stomach the potential rejection, the paycheck and flexibility of being a life insurance agent can be worth the effort.

Top Companies for Life Insurance Agents in the USA

When starting out as a life insurance agent, working for the right company is crucial. Here are some of the best-rated companies for life insurance agents in the USA:

- Northwestern Mutual – One of the largest life insurers in the U.S., known for providing excellent training and support for its agents.

- New York Life – A leader in life insurance, New York Life offers solid compensation packages and a strong emphasis on agent development.

- Prudential – Known for its comprehensive products and services, Prudential offers agents extensive training and career development.

- MassMutual – MassMutual has a reputation for providing a strong support system for its agents with competitive commissions.

- State Farm – Known for offering a broad range of insurance products, State Farm agents often benefit from a large network and extensive resources.

List Of Careers In Insurance

Here’s a non-exhaustive list of insurance company careers in the insurance world here, I hope this insurance jobs list of the best insurance job positions inspires you to consider a career in the insurance sector.

- Insurance broker jobs

- Insurance sales jobs

- Insurance field jobs

- Insurance jobs from home

- Insurance underwriter jobs

- Insurance investigator jobs

- Insurance inspector jobs

- Insurance assessor jobs

- Insurance compliance jobs

- Insurance claims jobs

- Insurance surveyor jobs

- Insurance adjuster jobs

- Insurance accounting jobs

- Insurance operations jobs

- Insurance trainer jobs

- Insurance consultant jobs

- Health insurance jobs

- Medical insurance jobs

- Insurance nurse jobs

- Life insurance jobs

- Car, auto or motor insurance jobs

- Property and casualty insurance jobs

- Marine insurance jobs

- Crop insurance jobs

- Commercial insurance jobs

- Insurance marketing jobs

- Insurance manager jobs

- Loss control and prevention

- HR jobs in insurance companies

- Life insurance recruitment

- Insurance agent recruitment

- Insurance headhunters

- Insurance company recruitment

- Insurance IT jobs in insurance companies

- Customer service representative

Although these insurance job titles and career paths are intertwined, you can head down any of these specialized paths based on your talents and desires, and build your insurance career in that specialization.

Furthermore, there are certain markets and demographics that are not sufficiently served by insurance companies. So, in the insurance industry, there are always new markets to access.

The ageing workforce is also creating many opportunities in the insurance industry, which makes endless career growth possible for good financial consultants and insurance agents.

So, if you want to join the financial services industry and learn from the wealth of experience and specialized knowledge of these seasoned financial consultants this is the perfect time to do it.

Overview of the Insurance Field

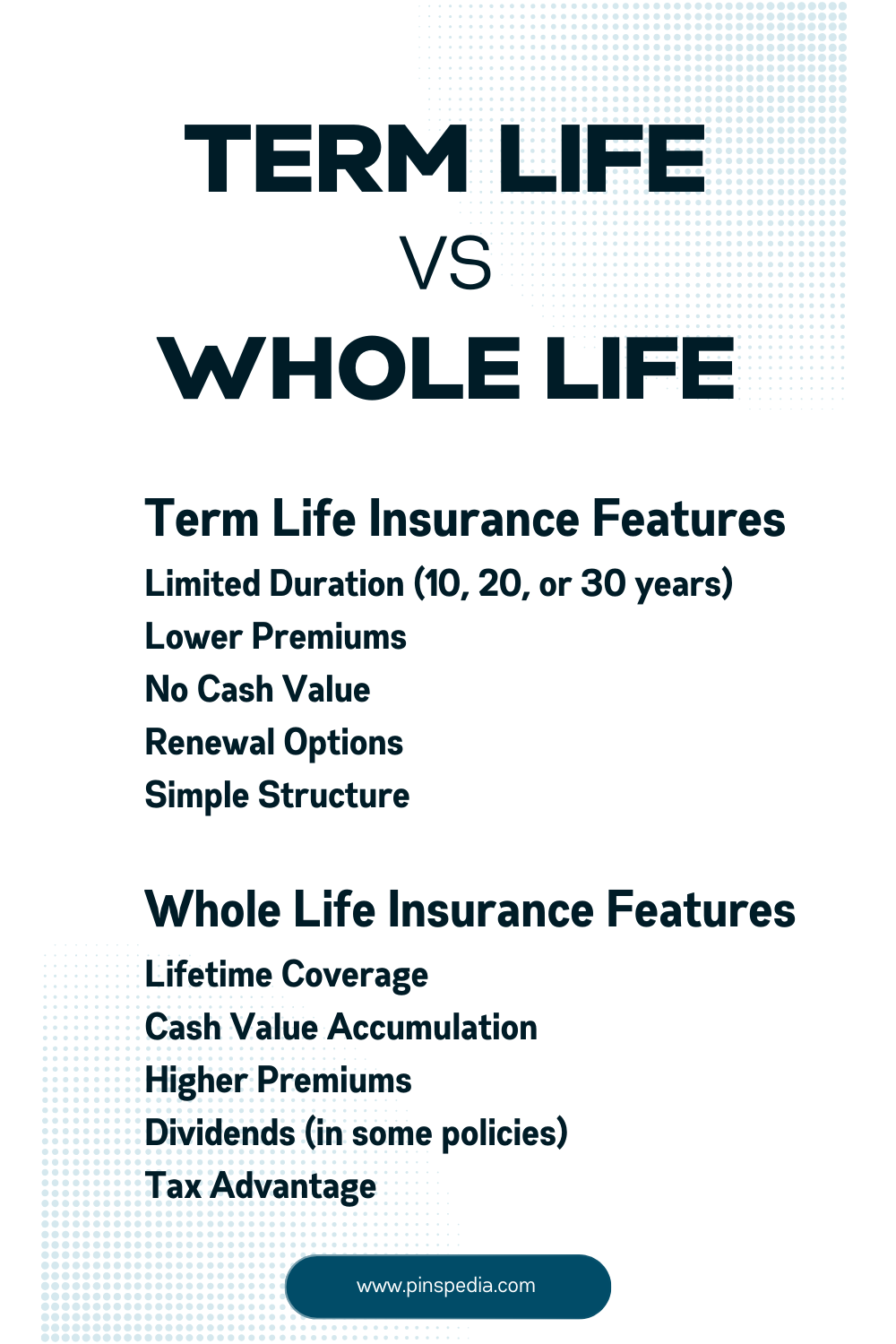

While there are many kinds of insurance (ranging from auto insurance to health insurance), the most lucrative career in the insurance field is for those selling life insurance. Agents focusing on this end of the insurance market help families, businesses, employers, and other parties protect against financial loss when someone dies.

Insurance agents selling this type of coverage are either “captive” agents, meaning they only sell insurance from one company, or “non-captive” agents, meaning they represent multiple insurance carriers. Either way, the typical insurance agent spends the majority of their time engaging in marketing activities to identify people who might need new or additional insurance coverage, providing quotes from the companies they represent, and persuading clients to sign new insurance contracts.

Typically, a life insurance agent receives anywhere from 30% to 90% of the premium paid by the client in the first year. In later years, the agent may receive anywhere from 3% to 10% of each year’s premium, known as “renewals” or “trailing commissions.”

Insurance Sales Commission Example

Uni, the insurance agent, sells Ryan a whole life insurance policy that covers Ryan for the rest of his life (assuming he continues to make premium payments). Uni’s insurance company pays a 90%/5% commission on whole life policies, meaning the selling agent receives 90% of the first year’s premium and 5% of future renewals.

The policy costs Ryan $100 per month or $1,200 per year. Thus, in the first year, Uni will make a $1,080 commission on selling this life insurance policy ($1,200 x 90%). In all subsequent years, Uni will make $60 in renewals as long as Ryan continues to pay the premiums ($1,200 x 5%). An agent selling one or two policies per week at this commission level could make $50,000 to $100,000 in their first year as an agent.

Life Insurance Agent Qualifications

A life insurance agent is not a profession for the thin-skinned or faint of heart. More than any other factor, including education and experience, life insurance agents must possess a fighting spirit. They must love the thrill of the hunt, the rush of a sale, and see rejection as a stepping stone to eventual success. This career is not ideal for those who are introverted, soft-spoken, or afraid of conflict.

The vast majority of life insurance companies have no formal education requirements for becoming an agent. While many prefer college graduates, this general rule is often overlooked in favor of the “right” candidates. Previous experience in the insurance industry is not required because most medium and large insurance carriers have internal programs to train their salespeople on the products they’ll be selling.

However, there is one non-negotiable hurdle: state licensing. Insurance agents must be licensed by the states in which they plan to sell insurance. This typically requires passing a state-administered licensing exam and taking a 20-50 hour licensing class.

Getting Hired to Sell Insurance

If a career in life insurance sales interests you, the first step is to create a resume that highlights your entrepreneurial spirit. Include examples of how you’ve taken initiative, started your own business, or helped someone else’s business grow. Resumes that demonstrate a track record of taking action will help you get noticed.

Next, find positions and start applying. Don’t feel pressured to accept the first job offer, as working for the wrong company could burn you out and affect your career long-term. Ideally, you want to work for a well-known company with a solid reputation among consumers and insurance rating agencies.

Use rating websites such as AM Best, Moody’s, and Standard & Poor’s to research the best companies with ratings of “A” or higher. These companies typically offer more secure products, better compensation packages, and stronger agent support systems.

The Challenges and Rewards

Life insurance sales can be grueling. The turnover rate for insurance agents is high, with many not lasting beyond their first year. However, this creates constant job vacancies, making it relatively easy for new hires to get started.

If you’re lucky enough to land a job, you can expect the first 12 months to involve lots of networking, handing out business cards, and making cold calls. Early on, your primary goal will be to find potential clients, and you may struggle financially until commissions start to roll in. While some companies offer a starting salary, this is becoming less common, with many agents being placed on a commission-only basis after initial training.

A Few Warnings

While the life insurance industry promises great rewards for those willing to work hard and face rejection, there are two key pitfalls to watch out for:

- You may be expected to market to friends and family. While this can be tempting to get started, it can also strain relationships.

- Always check your state insurance commissioner’s website for the complaint history of the companies you’re considering. Companies with less than an “A” rating or those using multilevel marketing often have a higher incidence of complaints.