Life Insurance Calculator

Use the calculator below to get a personalized estimate of how much term life insurance coverage may be right for you. Whether you’re starting a family, planning your financial future, or simply looking for peace of mind, this tool will help you take the first step toward protecting your loved ones.

Life Insurance Needs Calculator

Some Other Life Insurance Calculators

| Sr. No. | Calculator | Use Calculator |

|---|---|---|

| 1 | Term Life Insurance Coverage Calculator | Check |

| 2 | Term Life Insurance Quote Tool | Check |

| 3 | Life Insurance Needs Calculator | Check |

Understanding Life Insurance and Why It Matters

Life insurance is more than just a policy. It’s a financial safety net designed to protect the people who depend on you. If something happens to you, life insurance can provide the funds your family needs to continue living comfortably, manage expenses, and pursue long-term goals.

Many people either overestimate or underestimate how much coverage they actually need. This article will help you understand the purpose of life insurance, how to manually estimate the right coverage amount, and what to consider when choosing a policy.

What Is Life Insurance For?

Life insurance provides a tax-free lump sum to your beneficiaries in the event of your death. This payout, also known as the death benefit, can be used for:

- Paying off the mortgage or rent

- Covering daily living expenses

- Paying off personal debts or business loans

- Funding your children’s education

- Covering funeral or medical costs

- Supporting long-term financial goals

The key question is: how much is enough? That answer varies based on your unique life situation, which is why our calculator is a helpful starting point. However, if you want to understand how to calculate your needs manually, here’s a simple guide.

How to Manually Calculate Your Life Insurance Needs

Understanding how your life insurance needs are calculated can help you make informed decisions. Here is a step-by-step approach.

1. Estimate Your Family’s Annual Living Expenses

Begin by determining how much your family would need each year to maintain their current lifestyle. Include:

- Housing (mortgage, rent, utilities)

- Food and groceries

- Transportation

- Health care and insurance

- Education or child care

- Miscellaneous daily living costs

Example: $70,000 per year

2. Multiply Annual Expenses by the Number of Years You Want to Provide Support

Decide how long you want to provide financial support after your passing. This is often until your children are independent or until your spouse retires.

Example: $70,000 x 15 years = $1,050,000

3. Add Major One-Time Expenses and Financial Goals

Consider any big expenses or financial goals your family might face in the future.

- College education: Around $100,000 per child

- Wedding contributions

- Parental care

- Business or investment debts

Example: College for two children = $200,000

4. Add Outstanding Debts

Include any liabilities that would need to be settled in your absence.

- Mortgage balance

- Credit card debt

- Auto loans

- Business loans

Example: $250,000 mortgage + $20,000 credit card debt = $270,000

5. Subtract Existing Financial Assets and Coverage

Now subtract any assets that could support your family. This may include:

- Current life insurance coverage

- Savings and emergency funds

- Retirement accounts

- Investments

Example: $200,000 in assets and existing coverage

Final Calculation Example

Here’s how it all adds up:

Total annual support: $1,050,000

College savings: $200,000

Debt repayment: $270,000

Subtotal: $1,520,000

Minus assets: $200,000

Total life insurance need: $1,320,000

This individual should consider a policy of approximately $1.3 million.

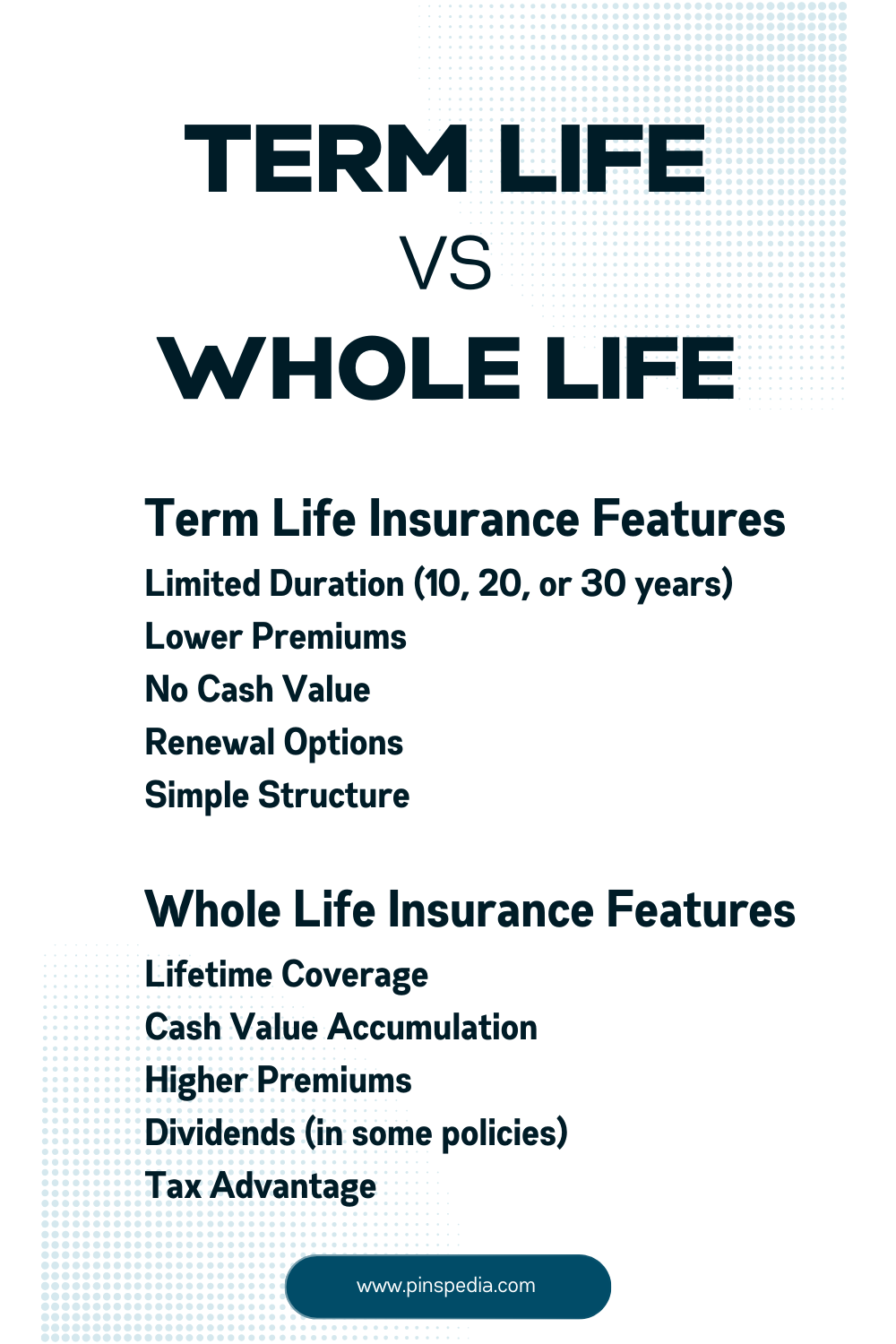

Understanding Term vs Whole Life Insurance

There are two main types of life insurance: term and whole life.

Term Life Insurance

- Covers you for a set period such as 10, 20, or 30 years

- Pays out only if you die during that term

- Typically the most affordable option

- Ideal for covering specific financial responsibilities like raising children or paying off a mortgage

Whole Life Insurance

- Provides coverage for your entire lifetime

- Includes a savings component that builds cash value

- More expensive than term life

- May be appropriate for long-term estate planning or wealth transfer

For most families and individuals, term life insurance offers the best combination of affordability and practical coverage.

Choosing the Right Term Length

The term length should match your key financial responsibilities. Here are some general guidelines:

- If you have young children or are early in your career, consider 20 to 30 years

- If your mortgage has 15 years left, a 15-year term might make sense

- If your kids are nearly independent or you are close to retirement, a 10-year term could be enough

How Much Does Term Life Insurance Cost?

Costs vary depending on:

- Age

- Gender

- Health history

- Lifestyle (smoking, hobbies)

- Coverage amount

- Policy term

A healthy 35-year-old non-smoker might pay around $25 to $35 per month for a $500,000, 20-year term policy.

Use our quote tool to get a personalized estimate based on your age, health, and desired coverage.

[Insert Link to Term Life Insurance Quote Tool]

When Should You Reevaluate Your Life Insurance?

You should review your coverage anytime you experience a major life change:

- Getting married or divorced

- Buying a home

- Having a child

- Changing jobs or starting a business

- Retirement planning

- A significant increase in income or expenses

As your financial situation evolves, so should your life insurance.

The Value of Planning Ahead

Thinking about life insurance can be uncomfortable, but taking the time to prepare now can protect your family from financial stress later. Life insurance is not about fear—it’s about taking responsibility and providing security.

With a combination of careful planning, tools like our calculator, and periodic reviews, you can ensure your coverage is aligned with your family’s needs and goals.

Take the First Step Today

If you haven’t already, scroll back to the top and use the calculator to estimate your coverage needs. It only takes a minute, but it can provide long-term peace of mind.

For personalized advice, speak with a licensed insurance professional who can guide you through your options and help you get the right coverage for your unique situation.