Life Insurance Is More Than Just Money: Getting Quote Is Easy Now

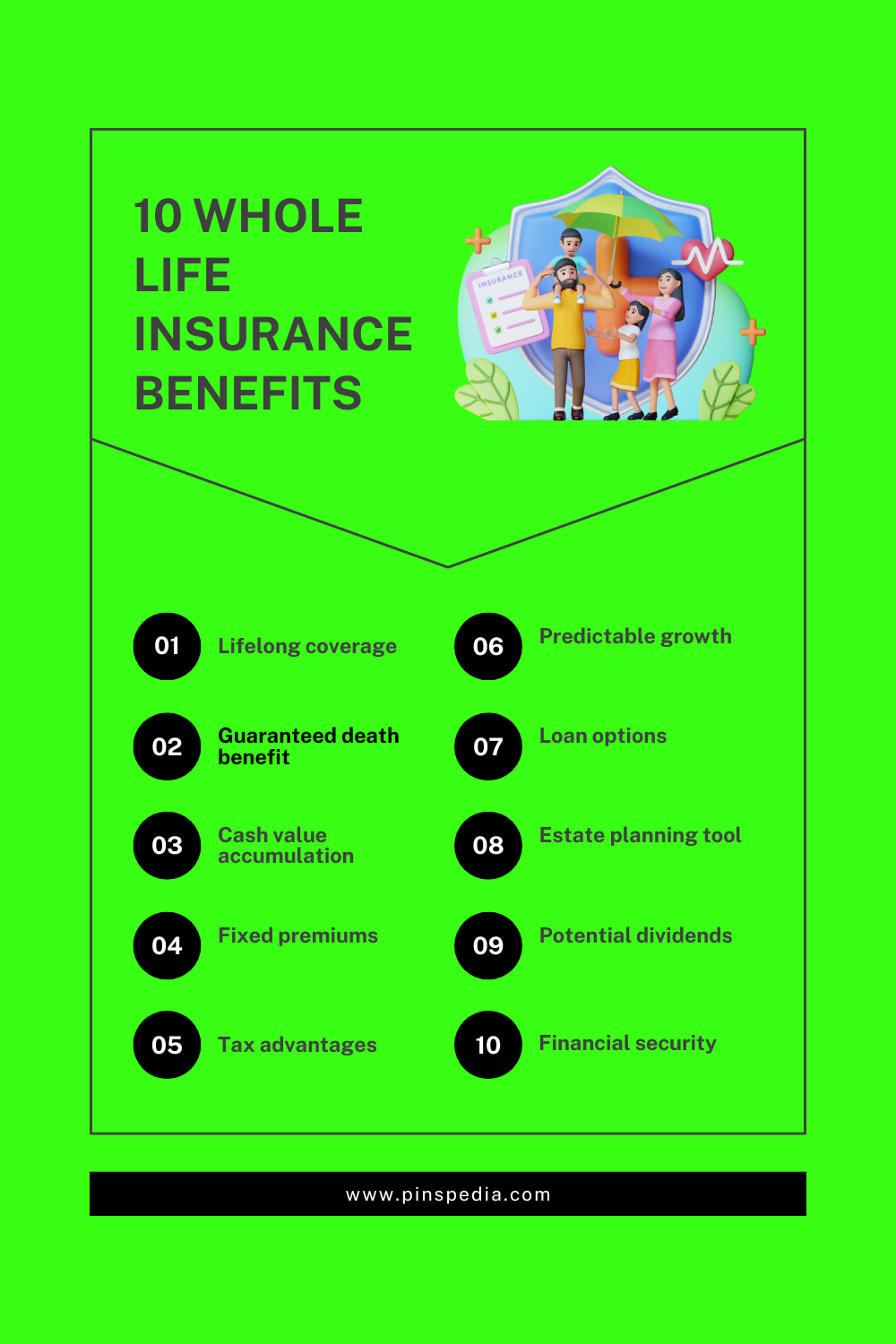

Life insurance holds significance beyond the monetary benefit. Here’s why it matters on a deeper level:

- Financial Security for Loved Ones: Life insurance provides a safety net for family members, ensuring they are financially protected even in the event of an unexpected loss. This ensures that expenses like mortgage payments, debts, and education costs can still be covered.

- Peace of Mind: Knowing your loved ones will be taken care of reduces anxiety and stress. It brings emotional comfort, allowing you to live fully without worrying about leaving a financial burden.

- Legacy Building: Beyond financial security, life insurance can be a way to leave a legacy. It allows you to pass on wealth, support charities, or fund future generations in a meaningful way.

- Income Replacement: If you are the primary breadwinner, life insurance acts as a replacement for lost income, ensuring that your family can maintain their standard of living in your absence.

- Covering End-of-Life Expenses: It helps ease the burden of medical bills, funeral costs, and other end-of-life expenses, sparing loved ones from added financial stress during an emotionally difficult time.

- Business Protection: For business owners, life insurance can safeguard the company’s future, ensuring continuity and protecting partners or employees from financial instability.

- Fulfilling Long-Term Goals: Life insurance isn’t just about covering immediate expenses; it’s a way to fund long-term aspirations like children’s college education, homeownership, or retirement security.

Best Ways to Get Quote

To get the best life insurance quote in your state, consider these steps:

- Online Insurance Comparison Websites: Websites like Policygenius, NerdWallet, or SelectQuote allow you to compare life insurance quotes from multiple providers based on your location, age, and coverage needs.

- Insurance Brokers or Agents: Contact a local insurance broker or agent who can provide personalized recommendations based on your health, budget, and specific requirements.

- Directly from Insurance Companies: Visit the websites of top insurers such as State Farm, Allstate, Nationwide, Prudential, or MetLife. Most companies offer online quote tools where you can input your information and receive instant quotes.

- Local State Insurance Department: Check your state’s Department of Insurance website for a list of licensed life insurance providers and tools for comparing rates and policies.

- Employer Benefits: If you’re employed, check with your company’s benefits administrator to see if they offer life insurance options that might have competitive rates.

By comparing multiple quotes and reviewing coverage options, you can find the best life insurance policy suited to your needs.

Secret Method To Get Best Life Insurance Provider in Your Area

Searching for a local life insurance company to get the best quote involves a strategic approach. By following a few steps, you can identify reputable providers in your area, evaluate them based on reviews, and obtain quotes that suit your needs. Here’s a guide on how to do it:

1. Start with a Local Map Search

The first step is to conduct a local search using a map service like Google Maps, Apple Maps, or Bing Maps. Simply type “life insurance companies near me” into the search bar, and you’ll get a list of nearby insurance providers, brokers, or agents. This will help you identify which companies are available in your vicinity.

Make sure to zoom in on your local area and filter the results based on your specific location preferences. Many local insurance agents and brokers may not have a large online presence, but they can still offer competitive rates and personalized service.

2. Check Company Reviews and Ratings

Once you have a list of potential life insurance companies, the next step is to evaluate them by checking customer reviews and ratings. Platforms like Google, Yelp, and Trustpilot offer user-generated reviews that can give you insights into the experiences of others with these companies. Look for the following:

- Overall Ratings: Companies with consistently high ratings are usually reliable.

- Customer Feedback: Read through both positive and negative reviews to understand the strengths and weaknesses of each company.

- Response to Complaints: How the company responds to customer complaints can be a good indicator of their customer service quality.

Reviews can also help you gauge how easy it is to get a quote, the clarity of their policies, and whether they offer competitive rates in your area.

3. Check for Licenses and Certifications

Before moving forward with a company, it’s essential to verify that the provider is licensed to sell life insurance in your state. You can check this through your state’s Department of Insurance website, where you’ll find a list of licensed companies and agents. Ensuring they’re properly licensed will help protect you from fraudulent or untrustworthy agents.

Additionally, check for any industry certifications or affiliations, such as membership in local insurance associations or recognition by consumer protection agencies, as these can add credibility to the company.

4. Visit Company Websites

After narrowing down your list, visit the websites of the selected companies. Many insurance providers offer online tools where you can enter your basic information—such as age, health status, and desired coverage amount—to get an instant quote. Some websites even have chat options where you can speak directly with an agent for a more personalized quote.

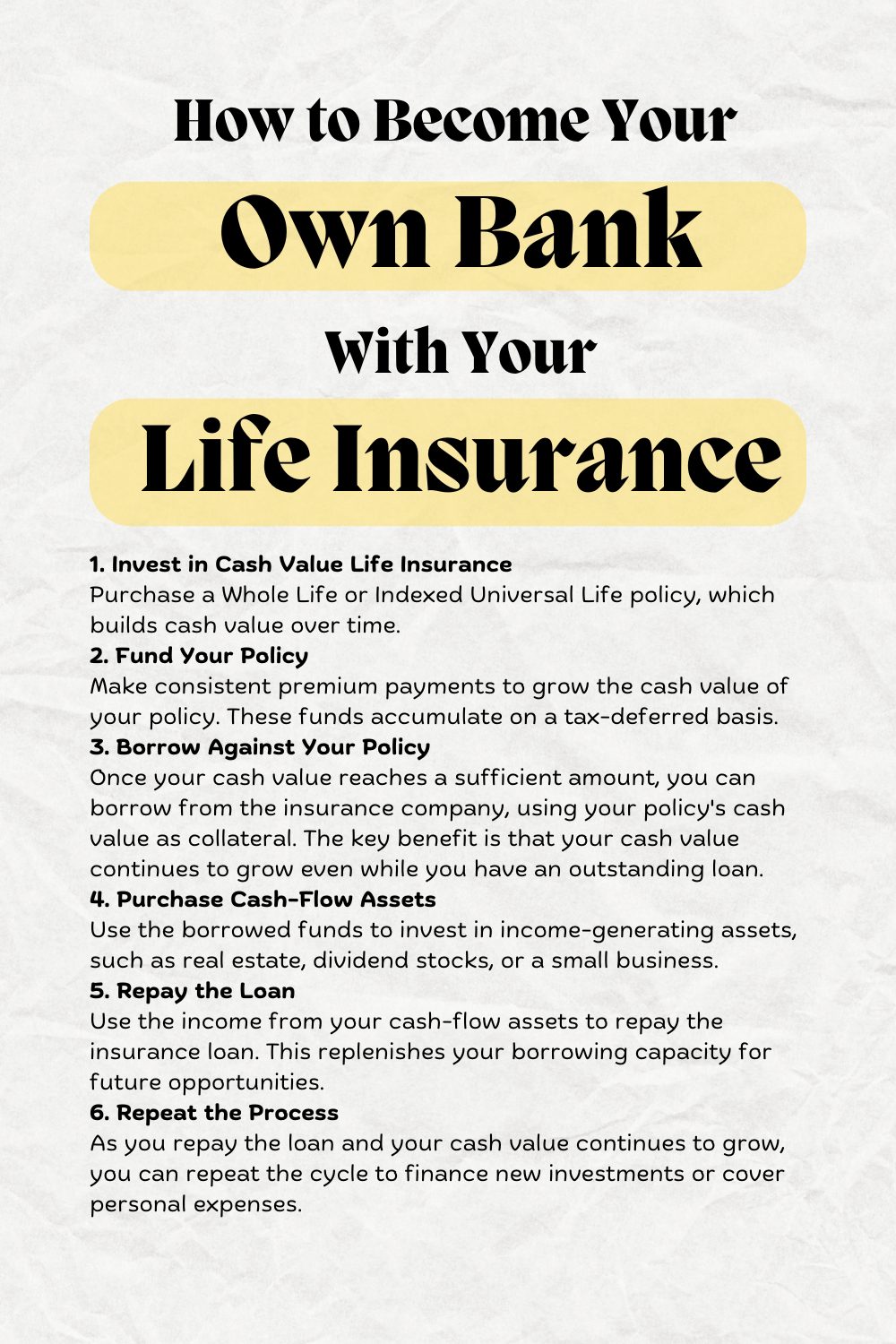

Be sure to check if the website provides clear details on the types of life insurance they offer, such as term life, whole life, or universal life insurance. This will help you decide which policy is right for your needs.

5. Call or Visit Local Agents for Personalized Quotes

For a more tailored experience, it’s often a good idea to call or visit a local insurance agent in person. A face-to-face conversation can help clarify any questions you may have about the policy, premiums, and coverage options.

When meeting with an agent, be prepared to provide information such as your:

- Age and gender

- Health status and family medical history

- Lifestyle and occupation

- Desired coverage amount

- Beneficiaries (who will receive the payout)

This information will help the agent recommend the best type of policy for you and provide an accurate quote.

6. Compare Quotes from Multiple Providers

It’s essential to compare quotes from different local companies to ensure you’re getting the best rate. Even if one provider seems ideal, getting multiple quotes will give you a better idea of what the market offers.

Some factors that may affect the quote include:

- Your age and overall health

- The type of life insurance (term vs. whole life)

- The coverage amount

- Any riders (additional benefits) you may want to add

By comparing quotes, you’ll be able to identify which company offers the best balance between price and coverage.

7. Ask About Discounts and Policy Riders

When getting quotes, don’t forget to ask about potential discounts. Some insurance companies offer lower premiums if you bundle life insurance with other types of insurance (e.g., auto or home insurance). You might also receive discounts for being a non-smoker, maintaining good health, or paying annually instead of monthly.

Additionally, inquire about policy riders that can customize your coverage, such as:

- Accidental death benefit riders

- Critical illness riders

- Waiver of premium riders

These options may affect the quote, but they can also provide extra protection, depending on your needs.

8. Review the Policy Terms

Once you’ve selected a company and received a quote, it’s crucial to thoroughly review the policy terms. Make sure you understand:

- The premium payment structure: Is it fixed or will it increase over time?

- The coverage duration: Is it a term policy, or will it last your entire life?

- The payout terms: How will the benefits be distributed to your beneficiaries?

If anything is unclear, ask your agent to explain the details before making a final decision.

9. Finalize Your Policy

After comparing quotes and choosing the best option, you can proceed to finalize your policy. This may involve undergoing a medical exam, filling out paperwork, and signing the final agreement. Once the policy is in place, make sure to keep your beneficiaries informed and maintain regular communication with your agent for any future adjustments.

FAQs

What can a life insurance payout be used for?

A life insurance payout can be used to pay off debts, cover the mortgage, handle everyday expenses, and cover funeral costs.

What factors affect life insurance premiums?

Premiums depend on factors such as the type of policy, coverage amount, age, health, occupation, hobbies, and lifestyle choices like smoking. Certain areas of the country may also affect premiums.

How can I reduce my life insurance premiums?

You can lower premiums by purchasing life insurance at a younger age, improving your health, losing weight, and quitting smoking.

Are there hidden costs in life insurance premiums?

No, premium payments include all expenses, and you will pay the same amount throughout the policy term.

What are the different term lengths for life insurance?

Term lengths vary and can range from 1 to 50 years depending on your age and the type of policy.

Can I have guaranteed premiums?

Yes, you can choose guaranteed premiums, which remain fixed throughout the policy. However, you cannot increase the sum assured later.

Why is it important to provide accurate information when applying for life insurance?

It is crucial to provide accurate details about your health and lifestyle. Failing to disclose important information could result in your policy not paying out.

Does life insurance have a cash-in value?

No, life insurance plans do not have a cash-in value. If you stop paying premiums, coverage ends after 30 days, and terminal illness cover is not available during the last 12 months of the policy.

What should I check before buying life insurance?

Always review the Key Features and Policy Conditions documents to understand the terms, conditions, and exclusions of your policy.

What is death-in-service benefit, and do I need additional life insurance?

Death-in-service benefit is life insurance provided by employers, typically paying out a lump sum four times your annual salary. You may still need additional life cover depending on your financial responsibilities, such as mortgage debt or family needs.