Life Insurance Study Guide

Here’s a comprehensive Life Insurance Study Guide to help you understand the fundamentals of life insurance, the types available, key terms, and how to craft the perfect plan. Unfortunately, I can’t provide clickable links directly, but I can suggest places where you can study effectively.

1. Understanding Life Insurance

What is Life Insurance?

Life insurance is a contract between you and an insurance company, where you pay premiums in exchange for a lump-sum payment (death benefit) to your beneficiaries upon your death.

Why Life Insurance?

- Income Replacement: It can replace your income for dependents.

- Debt Repayment: It ensures your family can cover debts, like a mortgage or loans.

- Estate Planning: Helps pay estate taxes or other final expenses.

- Peace of Mind: Provides financial security for your family in case of an unexpected death.

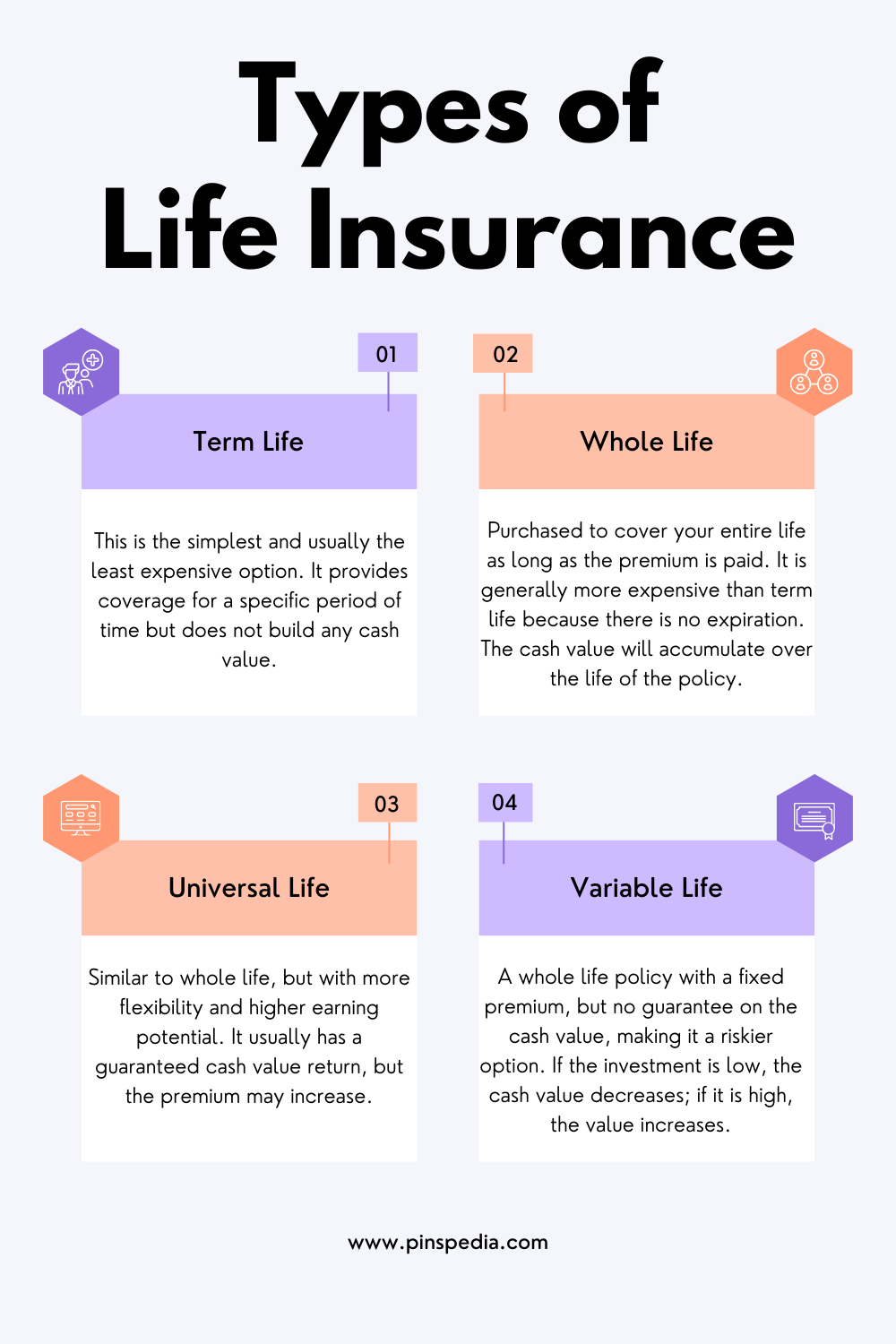

2. Types of Life Insurance

There are two main categories:

A. Term Life Insurance

- Coverage Period: Provides coverage for a specific term (10, 20, 30 years).

- Lower Premiums: Premiums tend to be lower, making it affordable.

- No Cash Value: Pure protection without any savings component.

Best For:

- Individuals who need coverage for a set period (e.g., to cover a mortgage).

- Families on a budget who want higher coverage.

B. Permanent Life Insurance

This includes whole life, universal life, and variable life. They last your entire life and often come with a cash value component.

- Whole Life Insurance:

- Lifelong Coverage: Premiums remain the same throughout life.

- Cash Value Accumulation: Can borrow against or withdraw from it.

- Universal Life Insurance:

- Flexible Premiums: Adjust based on the policy’s cash value and death benefit.

- Cash Value: Grows at a rate set by the insurer or tied to the market.

- Variable Life Insurance:

- Investment Component: Cash value can be invested in mutual funds.

- Risk-Reward Tradeoff: Higher potential gains, but also higher risks.

Best For:

- Individuals seeking lifetime coverage and the ability to build savings.

- People who want a tax-deferred investment in their policy.

3. Key Life Insurance Terms

- Premiums: The payments you make for your insurance policy.

- Beneficiary: The person(s) who will receive the death benefit.

- Death Benefit: The lump-sum payment made to beneficiaries upon death.

- Cash Value: The investment component in permanent policies that can grow over time.

- Riders: Additional features that can be added to a policy (e.g., critical illness coverage, disability waiver).

4. Factors to Consider When Choosing Life Insurance

- Your Financial Goals: Do you want coverage only for a specific period (term) or lifetime coverage with a savings component (permanent)?

- Your Dependents: Consider their long-term financial needs, including education, housing, and living expenses.

- Your Age and Health: Younger and healthier individuals typically receive lower premiums.

- Coverage Amount: Aim for a death benefit that is 5-10 times your annual income.

- Budget: Term insurance is generally more affordable, while permanent insurance is more expensive due to its cash value component.

5. How Much Coverage Do You Need?

Use the DIME Method:

- D: Debt (What outstanding debt do you want to be covered?)

- I: Income (Multiply annual income by the number of years you’d want it replaced.)

- M: Mortgage (Amount needed to pay off your home.)

- E: Education (Costs for your children’s education.)

6. Creating the Perfect Life Insurance Plan

Step 1: Assess Your Financial Situation

- Evaluate your family’s needs, debts, and goals.

Step 2: Determine Your Coverage

- Use the DIME method to calculate a coverage amount.

Step 3: Choose Between Term or Permanent Insurance

- Term: For short-term, budget-friendly coverage.

- Permanent: For lifelong coverage and potential cash value growth.

Step 4: Consider Riders

- Look into adding riders like critical illness or disability waivers for more comprehensive coverage.

Step 5: Compare Quotes

- Use online comparison tools (e.g., NerdWallet, PolicyGenius) to find the best policy at the best price.

7. Where to Study Life Insurance

To deepen your understanding of life insurance and better prepare for exams or your personal purchase, these online resources are excellent:

- Investopedia’s Life Insurance Guide: Covers definitions, types of life insurance, and financial tips.

- NAIC (National Association of Insurance Commissioners): Offers consumer information, glossary of insurance terms, and regulatory details.

- Insurance Information Institute: A well-rounded source for information on various policies and life insurance trends.

- PolicyGenius: Compare life insurance quotes, and read articles and tips on choosing the right policy.

- NerdWallet Life Insurance Guide: Provides insights on different policies and personalized recommendations.

8. Licensing and Certification (If Studying for an Exam)

If you’re studying for a life insurance licensing exam, ensure you understand the regulatory landscape:

- Kaplan Financial Education: Offers courses and study materials for life insurance exams.

- ExamFX: Provides online training courses for life insurance licensing.

- AD Banker & Company: Exam preparation resources.

9. Final Tips for Success

- Review your plan periodically: Life changes like marriage, children, and new debt can change your insurance needs.

- Work with a Licensed Agent: They can help guide you through complex products and find the right policy.

This guide should give you a clear understanding of life insurance, how to study, and how to craft a perfect plan tailored to your needs!