Trusts and Permanent life Insurance by Raymond Brown l Wealth & Retirement Expert

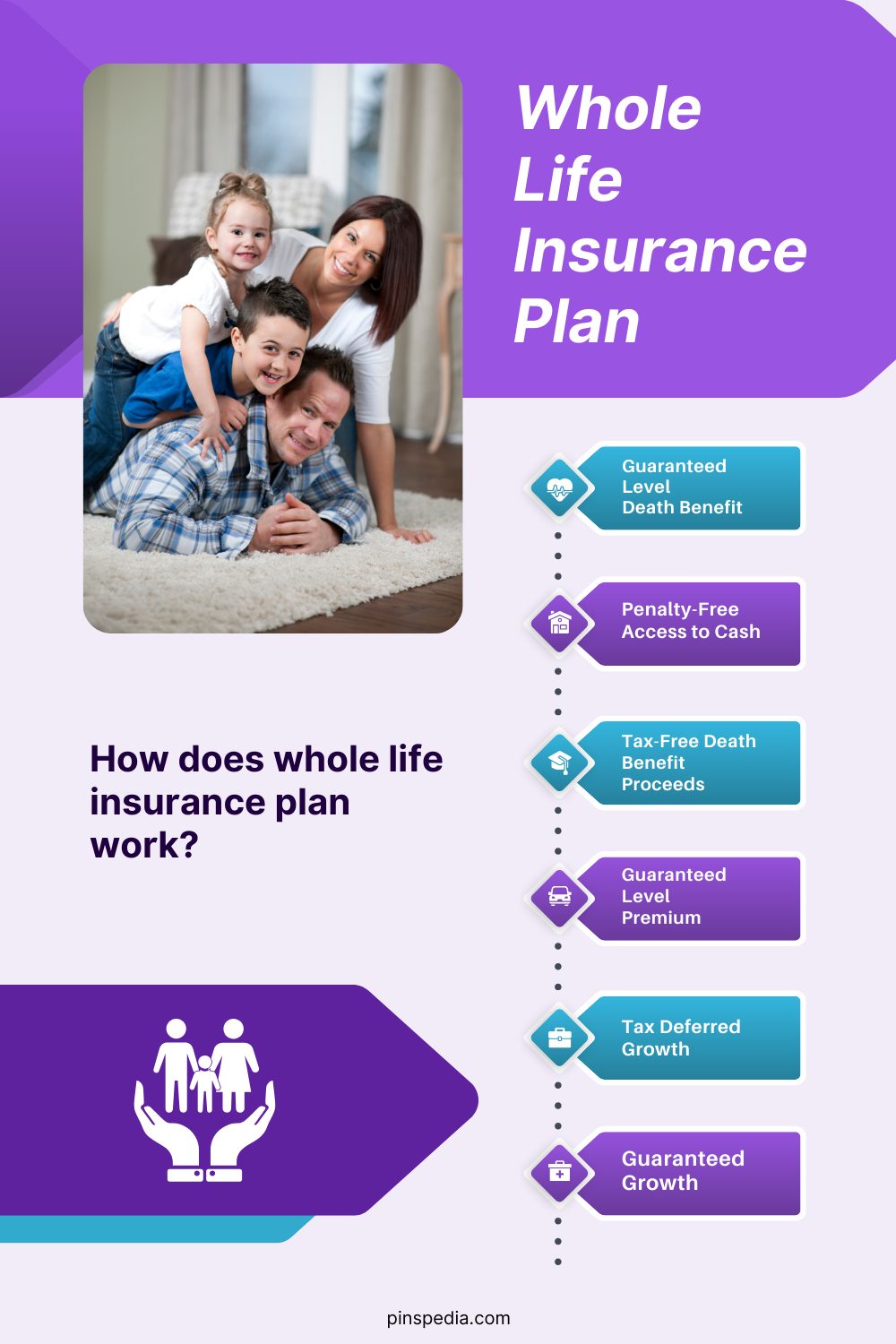

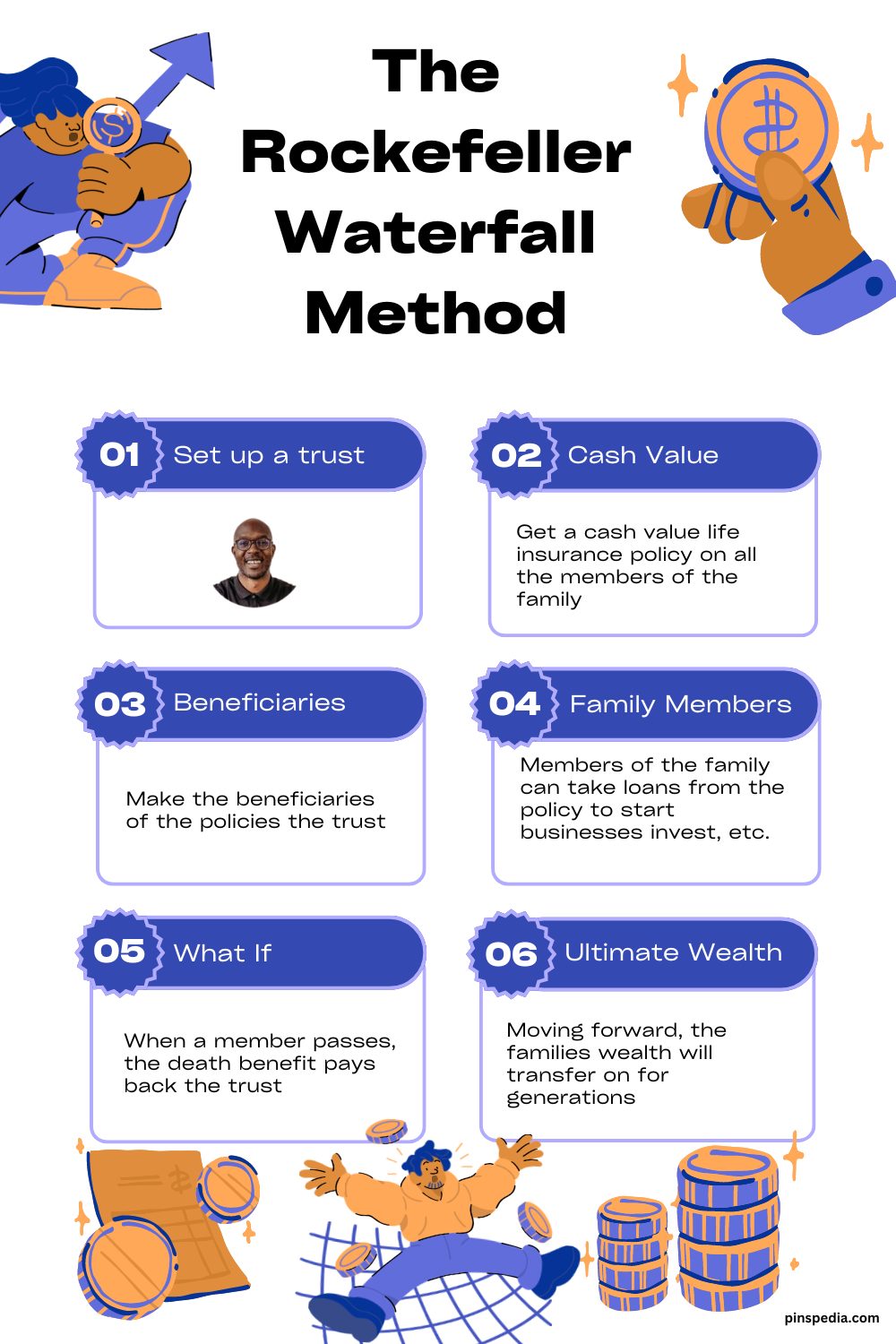

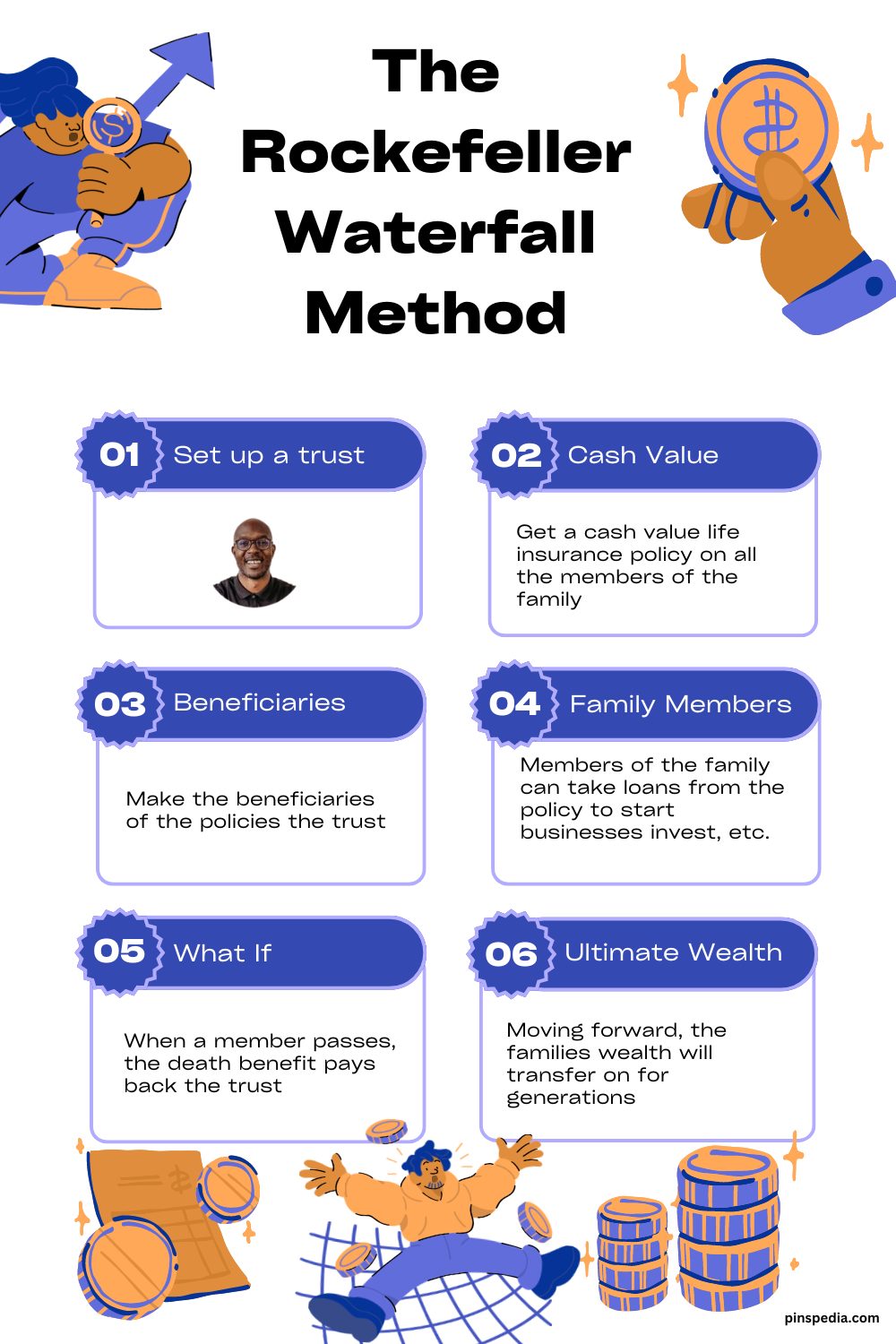

Raymond Brown, a leading expert in wealth and retirement planning, emphasizes that the key difference between wealthy individuals and the average person lies in their use of specific financial tools: trusts and permanent life insurance. These two strategies are often overlooked by those not accustomed to managing significant wealth, yet they are essential in the process of preserving and growing financial assets. Trusts provide a legal structure that can safeguard wealth for future generations, offering protection from taxes, creditors, and legal disputes. Permanent life insurance, on the other hand, offers both security and a wealth-building component, allowing individuals to accumulate cash value while ensuring a legacy for their heirs.

Building wealth doesn’t happen by accident—it requires deliberate planning and the strategic use of financial instruments designed to maximize asset protection and growth. Trusts, for example, can be tailored to meet a variety of needs, from managing charitable giving to ensuring that family members receive inheritances in a controlled and tax-efficient manner. Wealthy individuals understand the importance of these tools, using them not just to safeguard their current assets but also to ensure their financial legacy endures for generations to come.

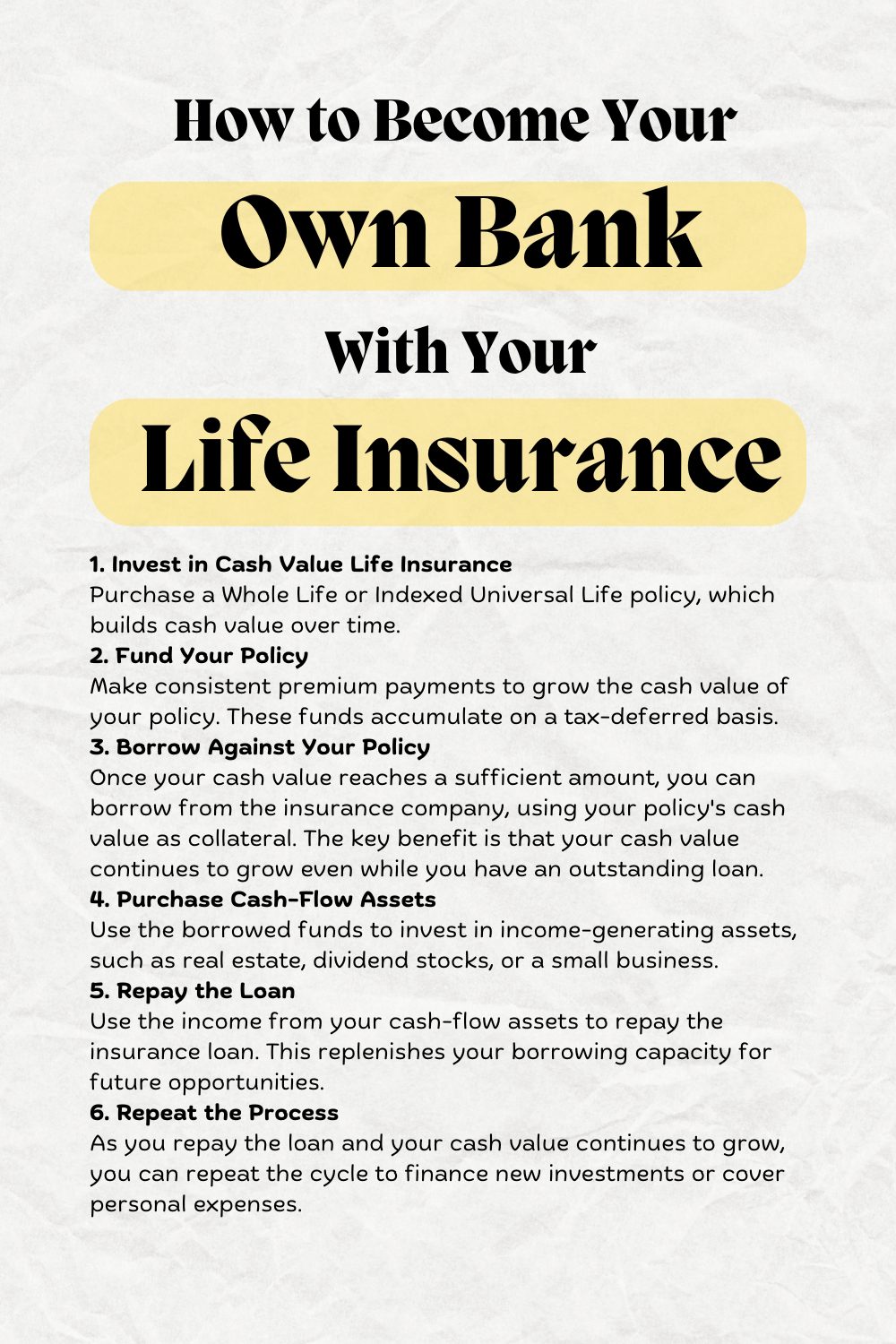

In contrast, the average person may focus more on basic savings and retirement accounts without exploring the broader financial strategies that can amplify their wealth. While saving and investing in the stock market are crucial, these approaches often lack the protective benefits and long-term growth potential that trusts and permanent life insurance provide. Permanent life insurance is particularly valuable because it not only provides a death benefit but also accumulates cash value over time, which can be borrowed against or used as a financial cushion in retirement.

Ultimately, the difference in wealth-building strategies highlights a gap in financial literacy. Understanding and utilizing tools like trusts and permanent life insurance is key to achieving financial independence and securing a prosperous future. With the right knowledge and planning, these strategies can be accessible to anyone looking to grow their wealth, not just the elite. Wealthy individuals recognize that building wealth isn’t just about earning more—it’s about using the right strategies to protect and grow what they’ve earned.

In this guide Raymond Brown provides perfect solution that you can learn and know Watch yourself: