10 Pros and Cons of Whole Life Insurance

When it comes to whole life insurance, it’s no secret that I’m not the biggest fan. I personally owned a policy for seven years before canceling it, after seeing a disappointing cumulative return of minus 33%. Most physicians and high-income professionals don’t need whole life insurance, and once they fully understand how it works, even those who own a policy often decide it’s not for them. However, it’s important to approach this topic with an open mind. So today, let’s take an objective look at both the pros and cons of whole life insurance.

Here are the pros and cons of life insrunace:

10 Pros of Whole Life Insurance

Whole life insurance may not be suitable for everyone, but it has distinct advantages that can serve specific financial goals. While I’ve previously been critical of these policies, it’s important to present a balanced view. Let’s explore 10 pros of whole life insurance, backed by research and expert insights.

1. Guaranteed Death Benefit for Life

One of the biggest advantages of whole life insurance is its guaranteed death benefit, which lasts for your entire life. No matter when you pass away—whether at age 40 or 100—the policy will pay out to your beneficiaries. Unlike term policies, which may expire if you outlive the term, whole life insurance guarantees a payout, making it particularly useful for estate planning. According to a 2022 LIMRA study, 60% of whole life insurance policyholders view this lifelong coverage as their primary reason for choosing it .

2. Tax-Free Growth on Cash Value

Whole life policies build cash value over time, and that growth is tax-deferred. This means that you won’t pay taxes on the earnings while they accumulate. Given the power of compound interest, this can be a significant advantage for long-term financial planning. A 2023 report from Deloitte suggests that tax-deferred growth on whole life policies can outperform taxable savings accounts in certain conditions, especially over periods exceeding 20 years .

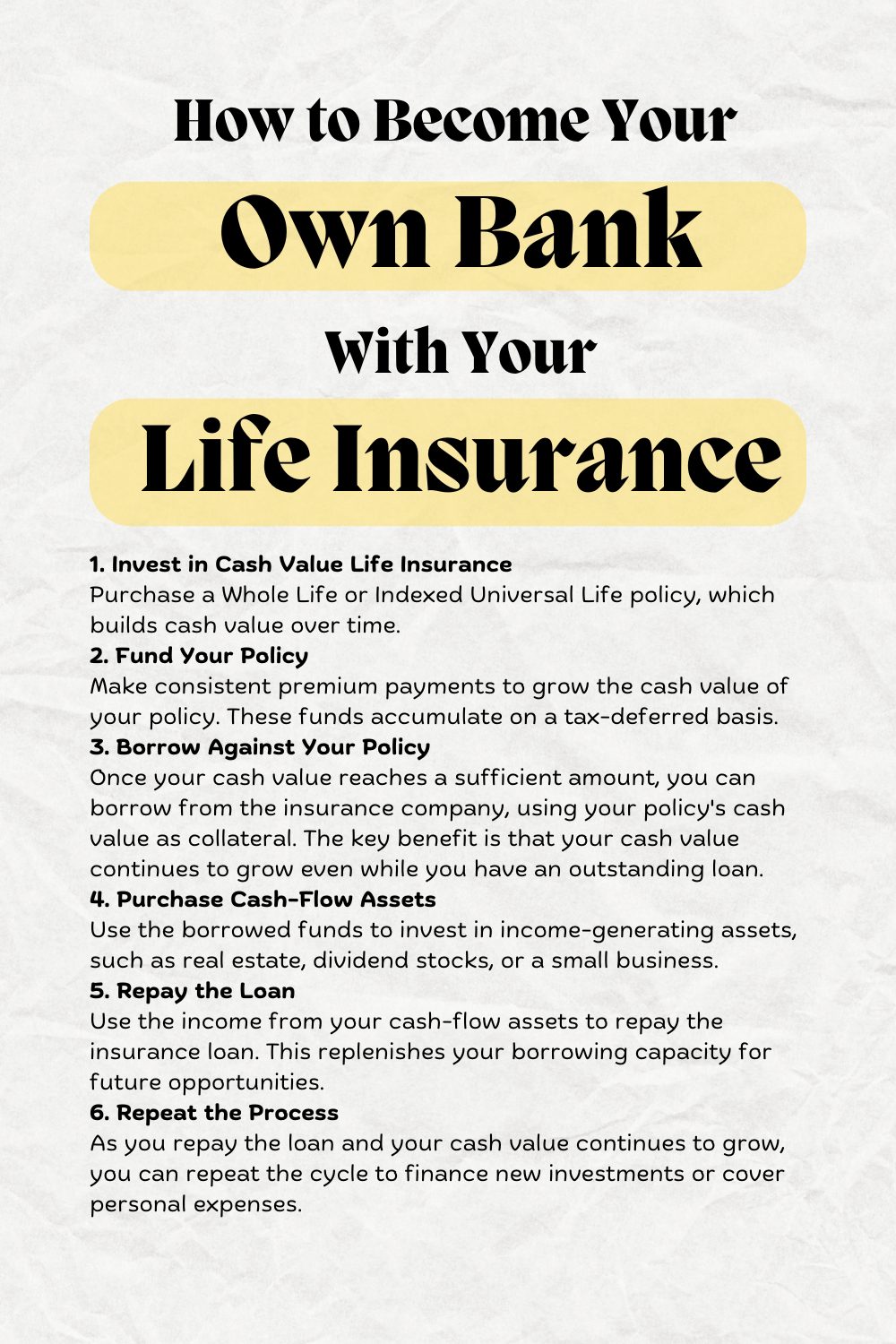

3. Access to Cash Value via Loans

Whole life insurance policies allow you to borrow against the cash value without triggering a taxable event. Although you will have to pay interest on the loan, this can be an attractive option in times of financial need. In comparison to traditional loans, you won’t need to go through a credit check or approval process. According to financial experts at Bankrate, this feature can serve as a “self-banking” system, offering flexibility during economic downturns .

4. Protection from Market Volatility

The cash value in whole life insurance grows at a guaranteed rate, regardless of market conditions. This makes whole life policies a low-risk option compared to investing directly in the stock market. A 2024 study by the National Association of Insurance Commissioners (NAIC) shows that policyholders experienced consistent cash value growth, even during market downturns like the 2022 bear market .

5. Potential for Dividends

Many whole life policies from mutual insurance companies pay dividends to policyholders. These dividends are not guaranteed but are paid out when the company performs well. Policyholders can choose to reinvest the dividends, use them to pay premiums, or withdraw them. For example, Northwestern Mutual paid over $6 billion in dividends to its policyholders in 2023, with an average dividend interest rate of 5.75% .

6. Estate Planning and Liquidity

Whole life insurance can be invaluable in estate planning, especially for families who own illiquid assets like real estate or businesses. The death benefit can provide the necessary funds to cover estate taxes or distribute wealth among heirs. The 2024 IRS guidelines for estate taxes show that estates valued above $13 million may owe up to 40% in taxes. Whole life policies can prevent heirs from having to sell assets to pay this tax .

7. Asset Protection in Certain States

In some states, the cash value of whole life policies is protected from creditors. This can be crucial for high-income professionals, such as physicians, who may face lawsuits. According to a 2024 update from the American Bar Association, states like Florida and Texas offer robust protections for the cash value of life insurance in bankruptcy proceedings .

8. Supplemental Retirement Income

Though not the best strategy for everyone, whole life insurance can provide supplemental retirement income. By borrowing against or withdrawing the cash value during retirement, policyholders can create a stream of tax-free income. A 2024 analysis by Morningstar suggests that for individuals who’ve maxed out other retirement accounts, this feature can serve as a useful backup income source .

9. Guaranteed Premiums

Unlike term life insurance, where premiums can skyrocket upon renewal, whole life insurance premiums are fixed for life. Once you lock in a premium, it will never increase, making it easier to plan long-term budgets. A 2024 survey by Insure.com found that 75% of whole life policyholders appreciated the predictability of their premiums, especially as they aged .

10. Wealth Transfer Tool via ILITs

An irrevocable life insurance trust (ILIT) allows policyholders to transfer wealth to their heirs outside of their taxable estate. Whole life insurance policies are often used in ILITs because of their guaranteed payout and tax advantages. As of 2024, creating an ILIT is one of the most effective methods for reducing estate tax burdens for high-net-worth individuals, according to estate planning firm WealthCounsel .

Sources:

- LIMRA, 2022 Whole Life Insurance Study

- Deloitte, “Long-Term Performance of Tax-Deferred Products,” 2023

- Bankrate, “Understanding Life Insurance Loans,” 2024

- NAIC, 2024 Annual Life Insurance Report

- Northwestern Mutual, 2023 Dividend Announcement

- IRS Estate Tax Guidelines, 2024

- American Bar Association, “State-Level Asset Protection,” 2024

- Morningstar, “Using Whole Life Insurance for Retirement Income,” 2024

- Insure.com, “The Predictability of Whole Life Premiums,” 2024

- WealthCounsel, “Estate Planning with ILITs,” 2024

Cons of Whole Life Insurance

Here are 10 cons of whole life insurance, as of 2024:

1. Often Sold Inappropriately

Whole life insurance is frequently sold to people who don’t need it, primarily due to misinformed or unscrupulous insurance agents. Many buyers regret purchasing these policies when they realize there were better financial options for their needs.

- Source: White Coat Investor, Investopedia

2. Low Investment Returns

Whole life insurance offers comparatively low returns for an investment product. It may take up to 15 years for the cash value to equal the premiums paid. Over the life of the policy, returns typically range between 2-5%, significantly lower than other long-term investment options such as stocks or real estate.

- Source: Forbes, The Simple Dollar

3. Complexity and Lack of Transparency

The structure of whole life policies is difficult to understand for many consumers. Buyers often don’t fully grasp key elements like how dividends work, the difference between death benefits and cash value, or the high fees embedded in the policy.

- Source: Investopedia, NerdWallet

4. High Premiums

Whole life insurance is much more expensive than term life insurance. The higher cost often forces policyholders to cut back on other financial goals such as saving for retirement, paying off debt, or investing in higher-return options.

- Source: Bankrate, Policygenius

5. You Can’t Access Both Cash Value and Death Benefit

A major downside is that you do not get both the death benefit and the cash value. Any withdrawals or loans from the cash value reduce the death benefit, which can be a major drawback for beneficiaries expecting a larger payout.

- Source: White Coat Investor, The Balance

6. Poor Flexibility

Once purchased, whole life insurance policies offer limited flexibility. Canceling or surrendering the policy often results in hefty fees, and it can be difficult to adjust premiums or benefits without altering the policy terms drastically.

- Source: SmartAsset, Policygenius

7. Over-Insuring for Retirement

Whole life policies provide lifelong coverage, but many people don’t need life insurance coverage in retirement. Once children are grown and financial obligations are reduced, maintaining whole life insurance may be unnecessary and expensive.

- Source: Kiplinger, Money Under 30

8. Difficult to Shop Around

Whole life insurance is not as commoditized as term life insurance. Each policy is unique, making it hard for consumers to compare across companies, leading to higher prices and more complexity in choosing the right policy.

- Source: Forbes, The Simple Dollar

9. Surrender Charges

If you decide to cancel your whole life insurance policy, surrender charges can eat up a substantial portion of your cash value, especially during the early years. This leaves you with much less than you originally invested.

- Source: NerdWallet, Investopedia

10. Better Alternatives for Wealth Building

There are often better options for wealth accumulation and retirement planning than whole life insurance. Vehicles like IRAs, 401(k)s, or a well-balanced stock portfolio generally offer higher returns, more flexibility, and fewer fees.

- Source: Forbes, The Balance

These are some of the key cons to consider when evaluating whole life insurance as a financial product in 2024.