Senior Life Insurance: How to Navigate the Options If You’re Over 50

As you age, securing life insurance can feel daunting, especially if you’re over 50. But the good news is that there are tailored options designed specifically to meet the needs of seniors. Senior life insurance, often referred to as “final expense insurance” or “burial insurance,” offers peace of mind by covering end-of-life costs and ensuring that your loved ones are financially secure. This guide will help you navigate the various types of life insurance available for seniors and help you determine the best option for your circumstances.

Understanding Senior Life Insurance

When you’re over 50, your life insurance needs shift. Unlike earlier in life when your focus may have been on income replacement or covering a mortgage, senior life insurance is usually about covering final expenses, including funeral costs, medical bills, and remaining debts. However, some policies can also provide a financial cushion for loved ones or even supplement your retirement savings.

Common Types of Senior Life Insurance

1. Term Life Insurance

Term life insurance is one of the simplest and most affordable forms of life insurance. It provides coverage for a set period, typically ranging from 10 to 30 years. If you pass away during this period, your beneficiaries receive the policy’s death benefit. Term life insurance is ideal for seniors who are still relatively healthy and looking for affordable coverage to last through a specific time frame, such as until a mortgage is paid off or until retirement funds become accessible.

- Pros: Affordable premiums, especially for shorter terms.

- Cons: No cash value accumulation, and the policy expires at the end of the term without payout if you outlive it.

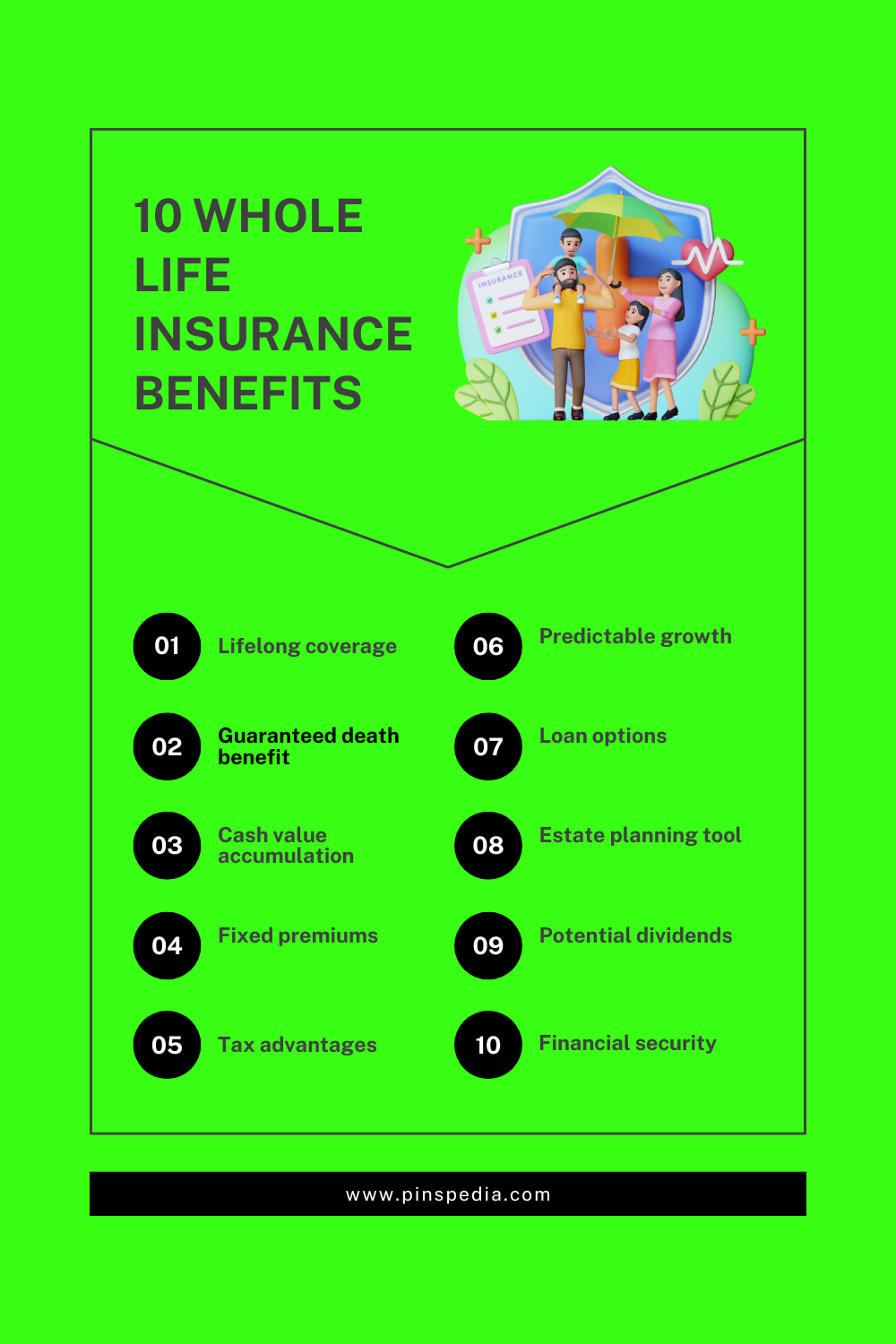

2. Whole Life Insurance

Whole life insurance offers permanent coverage, meaning it remains in effect as long as premiums are paid. It also builds cash value over time, which you can borrow against or withdraw in retirement. This type of policy is often more expensive than term life insurance but provides guaranteed benefits.

- Pros: Lifelong coverage, cash value accumulation.

- Cons: Higher premiums compared to term policies.

3. Guaranteed Universal Life Insurance (GUL)

Guaranteed universal life insurance is a hybrid between term and whole life insurance. It offers permanent coverage but typically without the significant cash value accumulation of whole life policies. Premiums are generally lower than whole life insurance, making it an attractive option for seniors who want lifetime coverage without the hefty price tag.

- Pros: Lifelong coverage with flexible premiums, lower cost than whole life.

- Cons: Minimal cash value accumulation, higher premiums than term insurance.

4. Final Expense Insurance

Also known as burial insurance, final expense insurance is specifically designed to cover the cost of funeral services and other end-of-life expenses. These policies usually offer smaller coverage amounts, ranging from $5,000 to $25,000, which can be sufficient for funeral costs, unpaid medical bills, or small debts.

- Pros: No medical exams required, guaranteed acceptance for most.

- Cons: Higher cost per dollar of coverage, lower death benefit amounts.

5. Guaranteed Issue Life Insurance

If you have health issues or are worried about being denied coverage, guaranteed issue life insurance may be the best option. This policy doesn’t require a medical exam or health questionnaire, but it typically comes with higher premiums and a lower payout. Additionally, there’s usually a waiting period (often two to three years) before the full death benefit is available.

- Pros: Guaranteed acceptance regardless of health, no medical exams.

- Cons: Higher premiums, limited benefits for the first few years.

Factors to Consider When Choosing Senior Life Insurance

1. Your Health

Your current health status will significantly impact your insurance options. Healthier seniors might qualify for more affordable term or whole life insurance, while those with pre-existing conditions may need to explore guaranteed issue or final expense policies. Be sure to compare quotes and policy details from multiple providers to find the best fit.

2. Coverage Needs

Determine how much coverage you need. Do you want enough to cover only final expenses, or are you looking for a policy that provides additional funds for your family? Calculate your debts, final expenses, and any financial support you want to leave behind to estimate the appropriate coverage amount.

3. Budget

Affordability is crucial, especially on a fixed income. Term life insurance is generally the most cost-effective, but if you want permanent coverage, final expense or guaranteed universal life insurance can offer a balance between cost and longevity.

4. Policy Duration

How long you need coverage is another important consideration. If you’re looking to cover specific liabilities like a mortgage, a term policy may be ideal. If you want lifelong coverage to ensure funeral costs are covered no matter when you pass, permanent options like whole life or guaranteed universal life insurance are better suited.

Additional Considerations for Seniors

1. Living Benefits

Some life insurance policies offer “living benefits,” which allow you to access a portion of your death benefit while still alive if you’re diagnosed with a terminal illness. This can be useful to cover medical expenses or other financial needs that arise during illness.

2. Cash Value Access

Permanent life insurance policies build cash value, which can be used during your lifetime. If you need extra funds during retirement, you can borrow from or withdraw this cash value. However, it’s important to remember that loans against your policy’s cash value may reduce the death benefit.

3. Funeral Preplanning

Some seniors choose to preplan their funeral and prepay the costs directly with a funeral home. This is an alternative to life insurance and can be a good option if your primary concern is covering funeral expenses. However, it doesn’t provide additional financial security for your loved ones like a life insurance policy would.

Making the Right Choice

Choosing the right senior life insurance policy can seem overwhelming, but it’s essential to carefully assess your needs, health, and financial situation. Start by determining how much coverage you need and for how long. Then, evaluate which type of policy best suits your situation—whether it’s term, whole life, guaranteed universal life, or final expense insurance.

Remember, many life insurance providers offer policies tailored for seniors, so don’t hesitate to shop around and compare quotes. Speaking with an insurance advisor who specializes in senior policies can also provide clarity and help you find the best solution for your needs.

Ultimately, securing life insurance after 50 doesn’t have to be complicated. With the right information and guidance, you can protect your loved ones and ensure that your final expenses are taken care of, providing peace of mind for you and your family.