Term Life vs Whole Life Insurance Simplified

Life insurance can often feel like a maze of terms and options, leaving many feeling overwhelmed. However, understanding the difference between term life and whole life insurance is crucial for financial security and peace of mind. This guide will simplify these concepts, empowering you to make informed decisions.

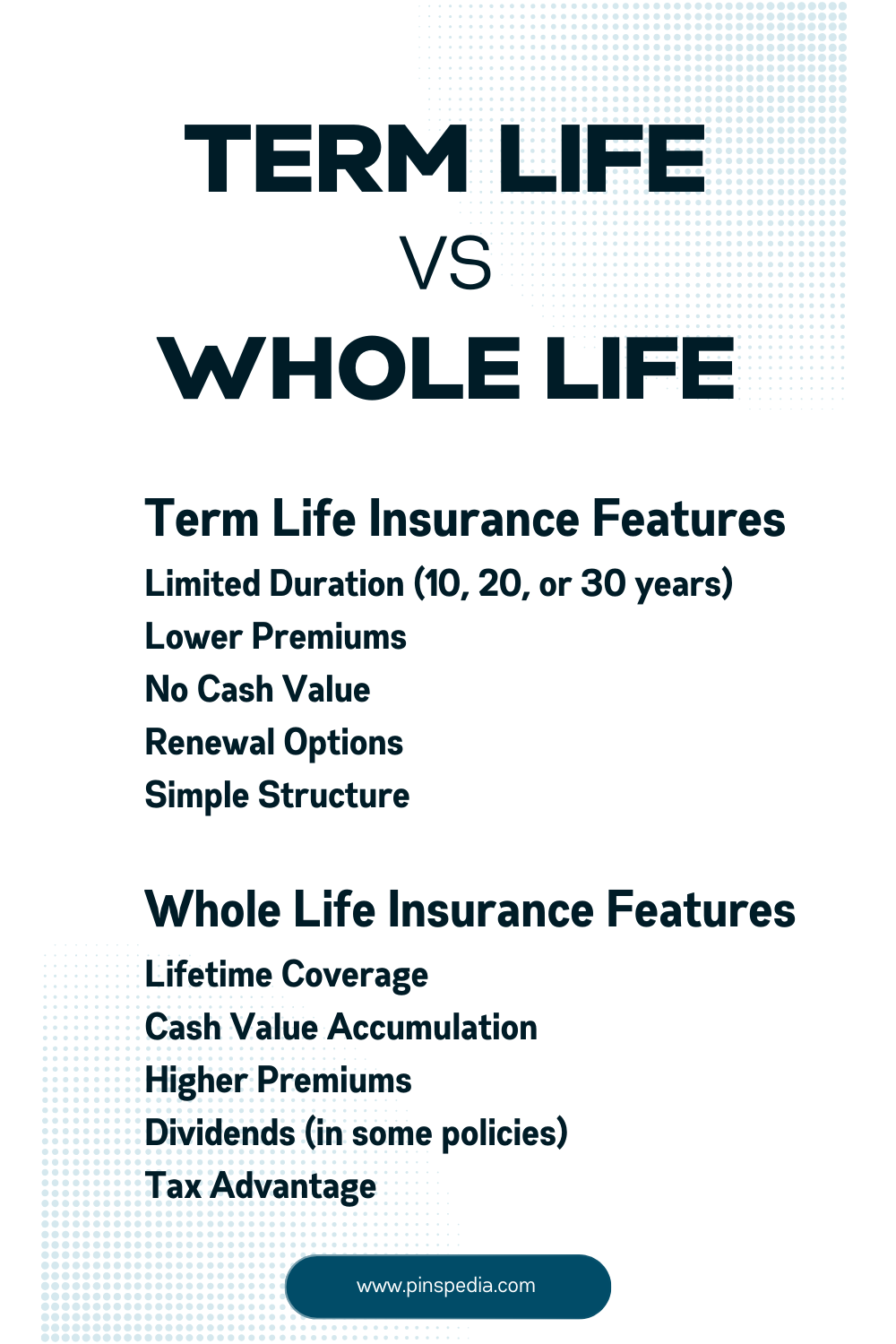

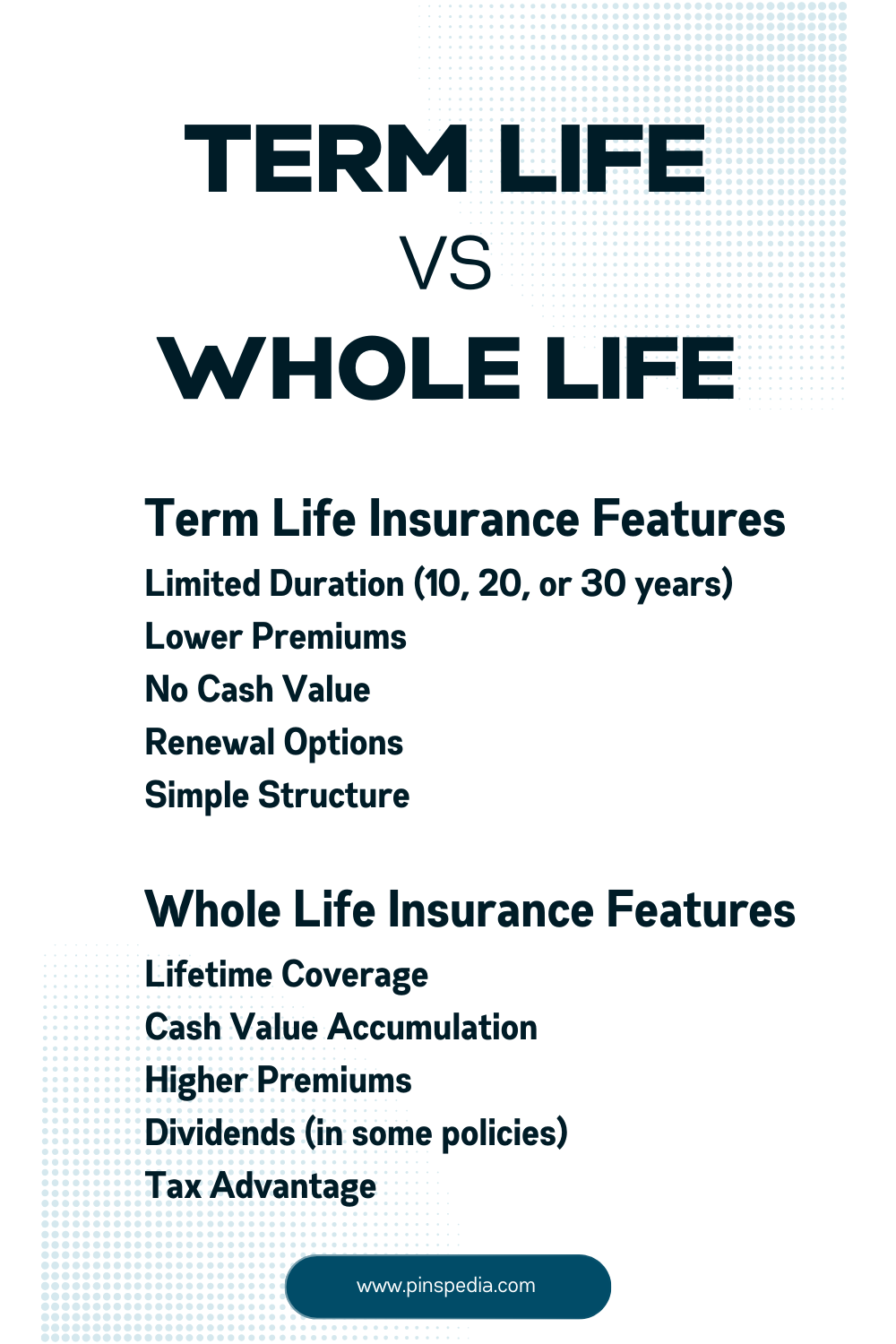

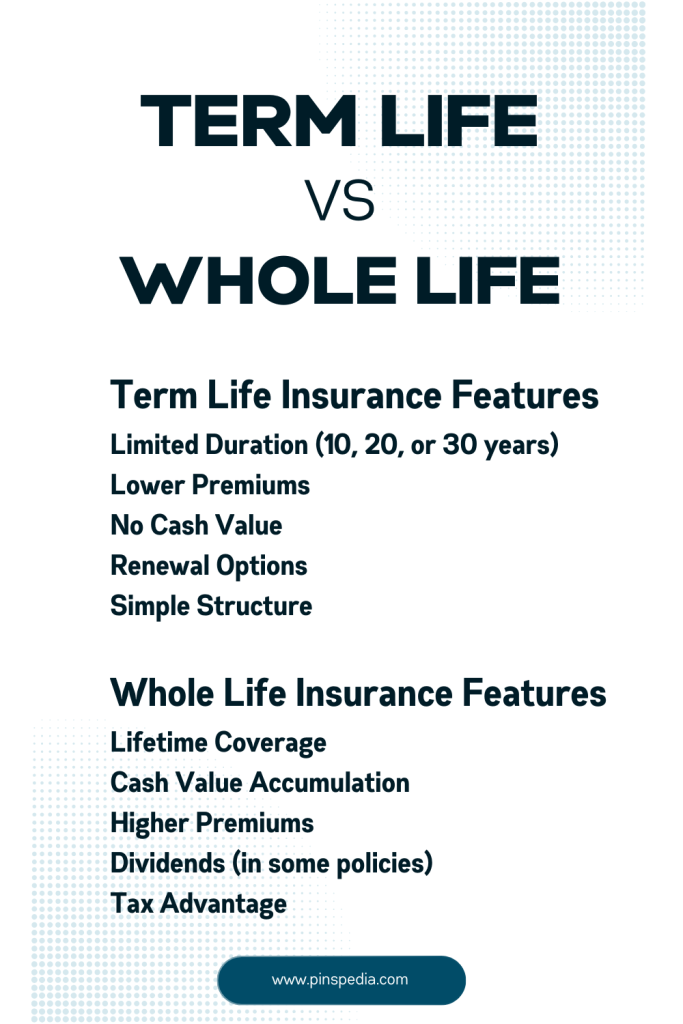

Here’s a concise table comparing Term Life Insurance and Whole Life Insurance:

Summary Table

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration of Coverage | Coverage for a specified term (e.g., 10, 20, or 30 years). | Lifetime coverage as long as premiums are paid. |

| Cost | Generally more affordable with lower premiums. | Typically more expensive due to cash value component. |

| Cash Value | No cash value accumulation. | Builds cash value over time, accessible through loans or withdrawals. |

| Payout | Pays death benefit only if the insured passes away during the term. | Provides a death benefit regardless of when the insured passes away. |

| Purpose | Ideal for covering temporary needs (e.g., mortgage, children’s education). | Suitable for lifelong coverage and wealth accumulation. |

| Renewability | May be renewable at the end of the term, often at a higher premium. | Generally not subject to renewal; coverage lasts a lifetime. |

| Investment Component | None; purely insurance coverage. | Acts as both insurance and an investment vehicle. |

| Flexibility | Less flexible; limited to the term length. | More flexible; can borrow against cash value or surrender policy. |

| Policy Loans | Not available. | Policyholders can borrow against cash value. |

| Tax Benefits | Death benefit is typically tax-free. | Cash value grows tax-deferred, and death benefit is tax-free. |

The Basics: What is Life Insurance?

Life insurance provides financial support to your loved ones in the event of your death. It’s designed to replace lost income, pay off debts, and cover funeral expenses. The two primary types of life insurance are term life and whole life, each with its own unique features and benefits.

Term Life Insurance: Affordable Protection for a Set Period

Definition: Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. If the policyholder dies within this term, the beneficiaries receive a death benefit.

- Pros:

- Affordability: Term life policies are generally cheaper than whole life policies, making them an accessible option for many families.

- Simplicity: They are straightforward, offering a clear death benefit without complex investment components.

- Ideal for Temporary Needs: Perfect for individuals with short-term financial obligations, such as mortgages or children’s education.

- Cons:

- No Cash Value: Term policies do not accumulate cash value; if you outlive the term, the policy expires without any payout.

- Renewal Costs: Renewing a term policy can become increasingly expensive as you age.

Statistics: According to the National Association of Insurance Commissioners, approximately 75% of life insurance policies are term policies, highlighting their popularity and affordability.

Whole Life Insurance: Lifetime Coverage with Cash Value

Definition: Whole life insurance provides coverage for the policyholder’s entire life, as long as premiums are paid. It includes a savings component, allowing the policy to accumulate cash value over time.

- Pros:

- Lifetime Coverage: Whole life insurance guarantees a death benefit regardless of when you pass away, as long as premiums are current.

- Cash Value Accumulation: A portion of your premiums builds cash value, which can be borrowed against or withdrawn if needed.

- Fixed Premiums: Premiums remain constant throughout your life, providing predictability in budgeting.

- Cons:

- Higher Premiums: Whole life policies are significantly more expensive than term policies, which may strain your budget.

- Complexity: Understanding the cash value component can be confusing, and it may take years to accumulate substantial value.

Statistics: According to a report from LIMRA, whole life insurance accounted for approximately 35% of new life insurance premiums in recent years, indicating its appeal as a long-term financial tool.

Choosing the Right Policy for You

The decision between term and whole life insurance largely depends on your financial situation and goals:

- Evaluate Your Needs: Consider your current financial obligations. If you have dependents relying on your income, term life insurance may be a suitable choice to ensure their security.

- Consider Your Age and Health: Younger, healthier individuals may find term policies more affordable, while those looking for lifelong coverage might lean toward whole life insurance.

- Long-Term Goals: If you aim to build cash value and prefer predictable premiums, whole life may align better with your financial strategy.

How Much Life Insurance Do You Need?

A common rule of thumb is to have coverage that is 10 to 12 times your annual income. For example, if you earn $50,000 annually, consider a term policy of $500,000 to $600,000. This ensures that your loved ones can maintain their standard of living and meet financial obligations even in your absence.

When to Get Life Insurance

If you have dependents or significant debts, it’s wise to secure life insurance sooner rather than later. Delaying could result in higher premiums due to age or health changes. Ideally, assess your needs when you start a family or take on a mortgage.

Conclusion: Take Control of Your Financial Future

Navigating life insurance doesn’t have to be daunting. By understanding the differences between term and whole life insurance, you can make informed decisions that protect your loved ones and align with your financial goals. Take the first step towards securing your family’s future by exploring your options today.

References:

- National Association of Insurance Commissioners (NAIC)

- LIMRA, Life Insurance Industry Trends Report

- Insurance Information Institute (III)