The Importance of Life Insurance as a Millennial: A Comprehensive Guide

As a millennial, life insurance might not be on the top of your list of financial priorities. With student loans, rising living costs, and saving for the future, life insurance may seem unnecessary, especially if you’re young and healthy. However, understanding the importance of life insurance early in your life can set a solid foundation for financial security, not only for you but for your loved ones as well.

This comprehensive guide explores the importance of life insurance for millennials, its benefits, and the key considerations you should keep in mind when choosing the right policy.

1. What is Life Insurance?

Life insurance is a contract between you and an insurance company. In exchange for your premium payments, the insurer provides a death benefit to your beneficiaries in the event of your passing. The purpose of life insurance is to offer financial protection to your loved ones in case you’re no longer there to support them.

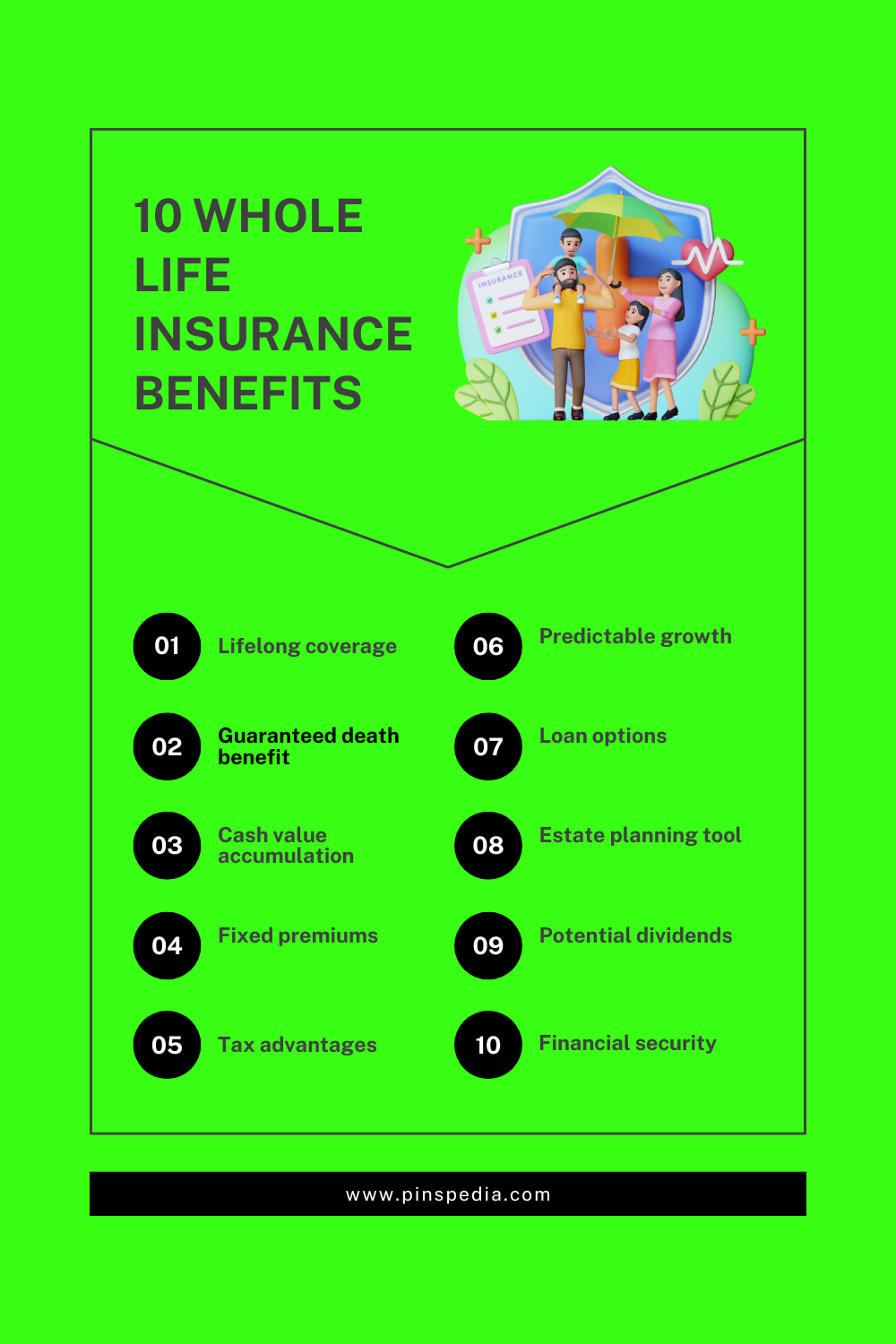

There are two main types of life insurance:

- Term life insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years) and is generally more affordable.

- Permanent life insurance (whole life or universal life): Offers lifetime coverage and includes a cash value component that grows over time.

2. Why Millennials Should Care About Life Insurance

a. Financial Protection for Loved Ones

If you have dependents (children, a spouse, aging parents), life insurance ensures they are financially secure if something happens to you. Millennials in their late 20s and 30s may already have families or are planning to start one. Life insurance can help cover expenses like:

- Mortgage payments

- Children’s education

- Outstanding debts

- Living expenses for surviving family members

Even if you don’t have dependents yet, purchasing life insurance while you’re young and healthy can lock in lower premiums.

b. Debt Repayment

Millennials are often burdened by student loans, credit card debt, or personal loans. In the event of your death, these debts don’t disappear. Life insurance can ensure that your co-signers (e.g., parents or a spouse) aren’t left with the financial burden of paying off these debts.

Some private student loans don’t get discharged upon death, meaning your loved ones could be held responsible. Life insurance can help avoid this financial strain.

c. Income Replacement

For millennials who are primary earners or contribute significantly to household income, life insurance can replace lost income for dependents. This is crucial for maintaining the family’s lifestyle, paying for ongoing bills, or covering future financial goals like retirement or education.

d. Final Expenses

Funeral costs can be significant, often ranging from $7,000 to $12,000. Life insurance can cover these expenses, so your family doesn’t have to worry about unexpected costs during a difficult time.

e. Peace of Mind

Life insurance isn’t just about financial protection—it also provides peace of mind. Knowing that your loved ones will be financially secure if something happens to you can reduce stress and allow you to focus on other life goals. This sense of security is invaluable, especially as you start building a family or taking on new financial responsibilities.

3. Benefits of Getting Life Insurance as a Millennial

a. Lower Premiums

Life insurance premiums are based on several factors, including age, health, and lifestyle. As a millennial, you’re likely to be younger and healthier than someone in their 40s or 50s. This allows you to lock in lower rates, which can save you a significant amount of money over time. Premiums tend to increase as you age or if you develop health conditions, so the earlier you get insured, the better.

b. Cash Value Accumulation (For Permanent Life Insurance)

For those who choose a permanent life insurance policy, there’s an additional benefit of cash value accumulation. This is a savings component that grows over time, allowing you to borrow against it or even withdraw funds for emergencies or other needs. The earlier you start, the more time your cash value has to grow, making it a potential financial asset in the future.

c. Protection Against Future Health Risks

As you age, the likelihood of developing health issues increases, and these can make it more difficult to qualify for life insurance or result in higher premiums. By purchasing life insurance when you’re young and healthy, you avoid the risk of being denied coverage later in life due to medical conditions.

d. Customizable Coverage

As millennials, your life circumstances can change rapidly—starting a family, buying a home, or changing careers. Life insurance policies can be adjusted to match your evolving needs. You can increase or decrease your coverage amount, convert a term policy into a permanent one, or add riders for additional protection, such as critical illness or disability coverage.

4. Common Misconceptions About Life Insurance Among Millennials

a. “I Don’t Need It Because I’m Young and Healthy”

While it’s true that younger people have a lower risk of death, unforeseen circumstances like accidents, illness, or other life events can still occur. Having life insurance is about being proactive and prepared for the unexpected.

b. “I Don’t Have Dependents Yet”

Even if you don’t have children or dependents, life insurance can be used to cover your outstanding debts, funeral expenses, or provide financial support to family members who may depend on you in other ways. Moreover, getting life insurance now helps secure lower premiums for when you do have dependents.

c. “It’s Too Expensive”

Many millennials overestimate the cost of life insurance. In reality, term life insurance can be quite affordable, especially for young and healthy individuals. For example, a healthy 30-year-old could get a $500,000 term life policy for as little as $20–$30 per month. The cost can be customized to fit your budget and needs.

5. How to Choose the Right Life Insurance as a Millennial

a. Assess Your Needs

Before purchasing a policy, determine how much coverage you need. Consider factors like:

- Income replacement

- Debt obligations

- Future financial goals (e.g., children’s education)

- Funeral and final expenses

A general rule of thumb is to get coverage that is 10–12 times your annual income, but this can vary based on your specific circumstances.

b. Choose Between Term and Permanent Insurance

For most millennials, term life insurance is the most cost-effective option, as it provides sufficient coverage at a lower price. If you’re looking for lifelong coverage or want a policy that builds cash value, consider permanent life insurance. However, keep in mind that permanent policies are more expensive and may not be necessary if you’re on a tight budget.

c. Compare Policies

Shop around and compare life insurance quotes from different companies. Look for reputable insurers with a strong financial standing and good customer service. Many companies offer online calculators to help you estimate your coverage needs and premiums.

d. Consider Additional Riders

Riders are add-ons that provide additional benefits to your life insurance policy. Some common riders include:

- Accidental death benefit rider: Provides an extra payout if death occurs due to an accident.

- Critical illness rider: Pays out a portion of your coverage if you’re diagnosed with a serious illness like cancer or heart disease.

- Disability waiver of premium: Waives your premiums if you become disabled and unable to work.

6. Conclusion

Life insurance is an important financial tool for millennials, offering peace of mind and financial security for your loved ones. By purchasing life insurance early, you can take advantage of lower premiums, protect against future health risks, and ensure that your family or dependents are financially protected in case of an unexpected event. Whether you’re starting a family, building your career, or simply looking for a safety net, life insurance is a smart and responsible investment in your future.

Final Tip

Take the time to explore your options and consult with a financial advisor if needed. The right life insurance policy can offer both protection and flexibility, tailored to your life’s needs and goals.