What Is Cash-Value Life Insurance and How Should You Use It?

Cash-value life insurance is a type of permanent life insurance that not only provides a death benefit but also accumulates cash value over time. This makes it a hybrid financial tool, offering both protection and a form of savings or investment. While some critics advocate for buying term life insurance and investing the difference, cash-value policies have distinct advantages when used appropriately.

In this guide, we’ll explore what cash-value life insurance is, how it works, and how you can leverage it as a part of a broader financial strategy.

What Is Cash-Value Life Insurance?

Cash-value life insurance refers to policies that build up a cash reserve alongside providing life insurance protection. The cash value grows tax-deferred and can be accessed in several ways during the policyholder’s lifetime. Popular types of cash-value policies include:

- Whole Life Insurance: The most conservative option, with guaranteed returns and a fixed premium.

- Universal Life Insurance (UL): Offers flexible premiums and death benefits, with cash value that earns interest based on current rates.

- Variable Universal Life (VUL): Allows policyholders to invest the cash value in various sub-accounts, similar to mutual funds, offering higher growth potential but also more risk.

Types of Cash-Value Life Insurance

Cash-value life insurance comes in various forms, each with different features, risk profiles, and growth potential. The most common types are whole life, universal life, and variable universal life insurance.

Whole Life Insurance

Whole life insurance is the most traditional form of cash-value insurance. It offers a guaranteed death benefit, fixed premiums, and a savings component that grows at a guaranteed rate. Whole life policies are often viewed as conservative, stable options because the cash value grows predictably over time, making it easy for policyholders to plan around future financial goals.

While the return on investment (ROI) with whole life insurance may not be as high as other financial vehicles, the policy’s predictability and security make it a reliable choice for risk-averse individuals. The policyholder can also take out loans against the cash value, adding an element of financial flexibility.

Universal Life Insurance

Universal life insurance provides more flexibility than whole life insurance. It allows policyholders to adjust their premiums and death benefit amounts within certain limits. The cash value in a universal life policy grows based on interest rates set by the insurance company, meaning returns can vary.

During periods of high interest rates, your cash value can grow faster, but if rates fall, so can the growth of your policy. Despite this variability, universal life insurance policies can offer more upside potential than whole life policies, making them suitable for those willing to accept more risk in exchange for possible higher returns.

Variable Universal Life Insurance

Variable universal life (VUL) insurance offers even greater flexibility by allowing policyholders to invest the cash value in a range of stock and bond sub-accounts, similar to a 401(k). The performance of these investments directly impacts the cash value of the policy, which means the growth potential is higher—but so is the risk.

VUL policies are ideal for individuals who are comfortable with market fluctuations and are looking to actively manage their life insurance investment. Like other cash-value policies, you can borrow against the cash value, but with the added risk that a downturn in the market could reduce the available funds.

Tax Advantages of Cash-Value Life Insurance

One of the primary appeals of cash-value life insurance is the tax advantages it offers. Both the death benefit and the cash value grow on a tax-deferred basis, meaning you won’t pay taxes on any growth in the policy’s cash value until you withdraw it. This allows for potential significant tax savings over time, especially for high-income individuals looking to minimize their tax burdens.

Additionally, you can access the cash value through policy loans, which are not considered taxable income as long as the policy remains in force. This feature provides a tax-efficient way to tap into your savings or investment gains during your lifetime without triggering a tax event.

If managed correctly, policyholders can recover their cost basis (the sum of premiums paid) through partial surrenders without tax consequences. After withdrawing your basis, you can switch to loans to continue accessing the cash value tax-free. Upon death, the loan balance is typically subtracted from the death benefit, allowing the remaining benefit to pass to beneficiaries tax-free.

Costs of Cash-Value Life Insurance

Cash-value life insurance policies are generally more expensive than term life insurance due to their permanent nature and investment component. However, it’s important to understand what you’re paying for. Whole life policies have fixed premiums, while universal and variable universal life policies offer more flexibility in premium payments.

Costs typically include the base premium, policy fees, and the cost of insurance (COI), which increases as you age. In a variable universal life policy, additional investment management fees can also apply, reducing the policy’s growth potential if not carefully monitored.

It’s essential to properly fund a cash-value policy to avoid issues like lapsing or needing additional infusions of cash. Underfunding can lead to a policy losing its tax-advantaged status or even lapsing, which can result in significant tax liabilities if loans have been taken against the policy.

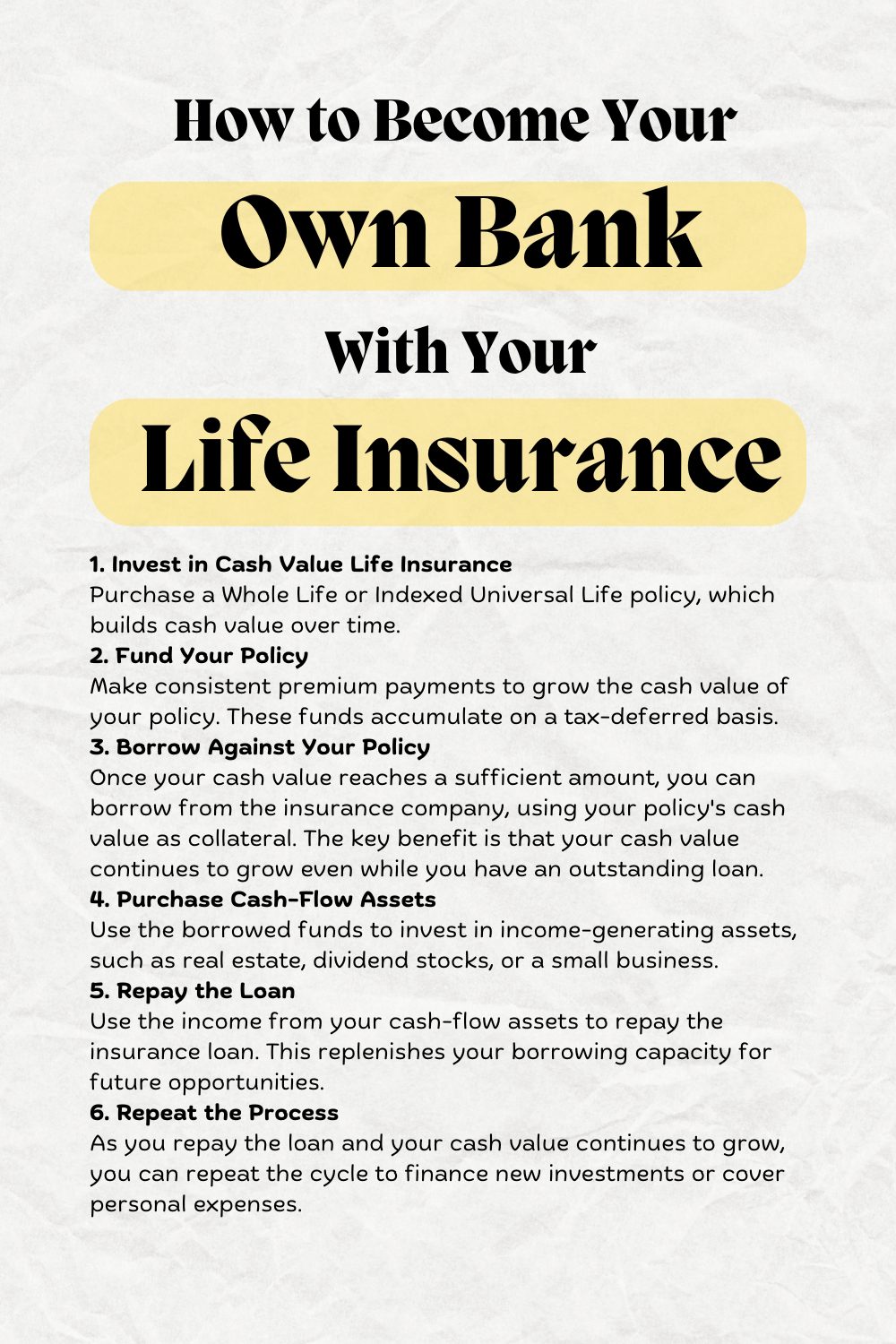

How to Use Cash-Value Life Insurance Effectively

The effectiveness of cash-value life insurance depends on your financial goals and how you use the policy. Here are a few key strategies:

- Long-Term Investment Vehicle: Cash-value life insurance is not suited for short-term goals due to the time it takes to build up significant cash value. These policies are better for those with long-term financial objectives, such as funding retirement or leaving a legacy.

- Tax-Advantaged Savings: Use the cash-value component as a tax-deferred savings or investment tool, especially if you’re already maximizing contributions to other tax-advantaged accounts like 401(k)s or IRAs. Accessing the cash value through loans can provide a tax-efficient source of retirement income or emergency funds.

- Legacy Planning: Cash-value life insurance can be an effective tool for estate planning. The death benefit is generally passed on tax-free, making it an excellent way to transfer wealth to heirs or support charitable causes.

- Business Continuity: For business owners, cash-value life insurance can be used to provide liquidity for buying out a partner’s share or funding estate taxes upon death. The policy can also be used to secure loans or provide additional financial security.

Common Mistakes to Avoid

While cash-value life insurance has many benefits, it’s not without its risks. Here are some common mistakes to avoid:

- Underfunding the Policy: Not contributing enough can lead to low accumulation values or even policy lapses. Maximize your contributions to take full advantage of the policy’s tax-advantaged growth.

- Using It for Short-Term Goals: Cash-value life insurance takes time to build significant value. If you’re looking to fund a near-term goal, such as paying for your child’s college, this might not be the best option.

- Overestimating the Death Benefit: If your goal is to accumulate substantial cash value, a larger death benefit will be required. However, don’t overestimate the cash value that can be accumulated in a short period.

- Ignoring Policy Fees: Pay close attention to the fees and charges associated with universal and variable universal life policies, as they can significantly erode your cash value over time.

Final Thoughts on Cash-Value Life Insurance

Cash-value life insurance can be a powerful financial tool when used correctly. It offers permanent coverage, tax-deferred growth, and financial flexibility through policy loans. However, it’s essential to consider your long-term financial goals, risk tolerance, and funding ability before choosing a cash-value policy.

Whether it’s for retirement savings, business protection, or legacy planning, cash-value life insurance can offer unique advantages that go beyond the traditional benefits of term life insurance. But like any financial tool, its success lies in proper management and understanding its limitations.