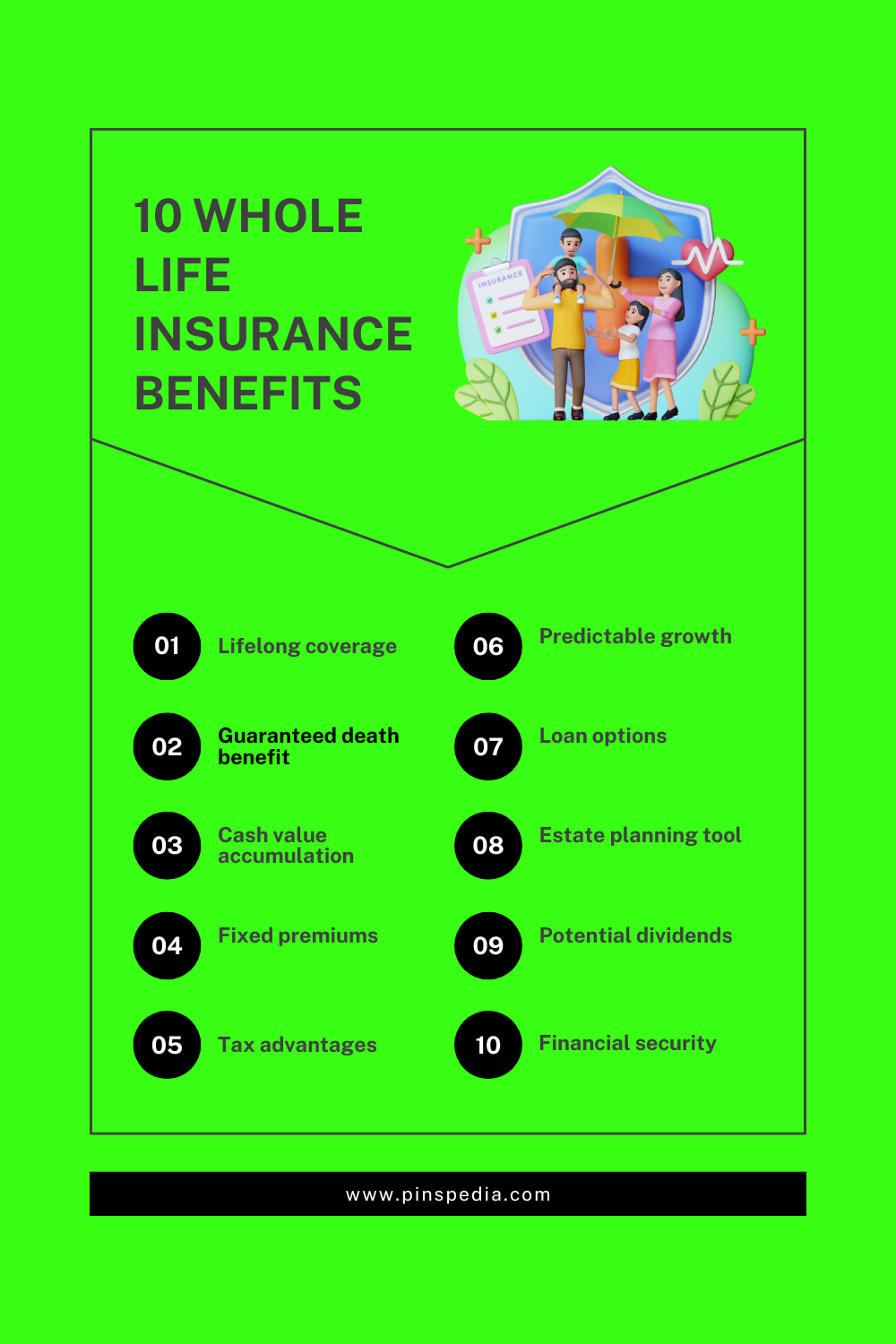

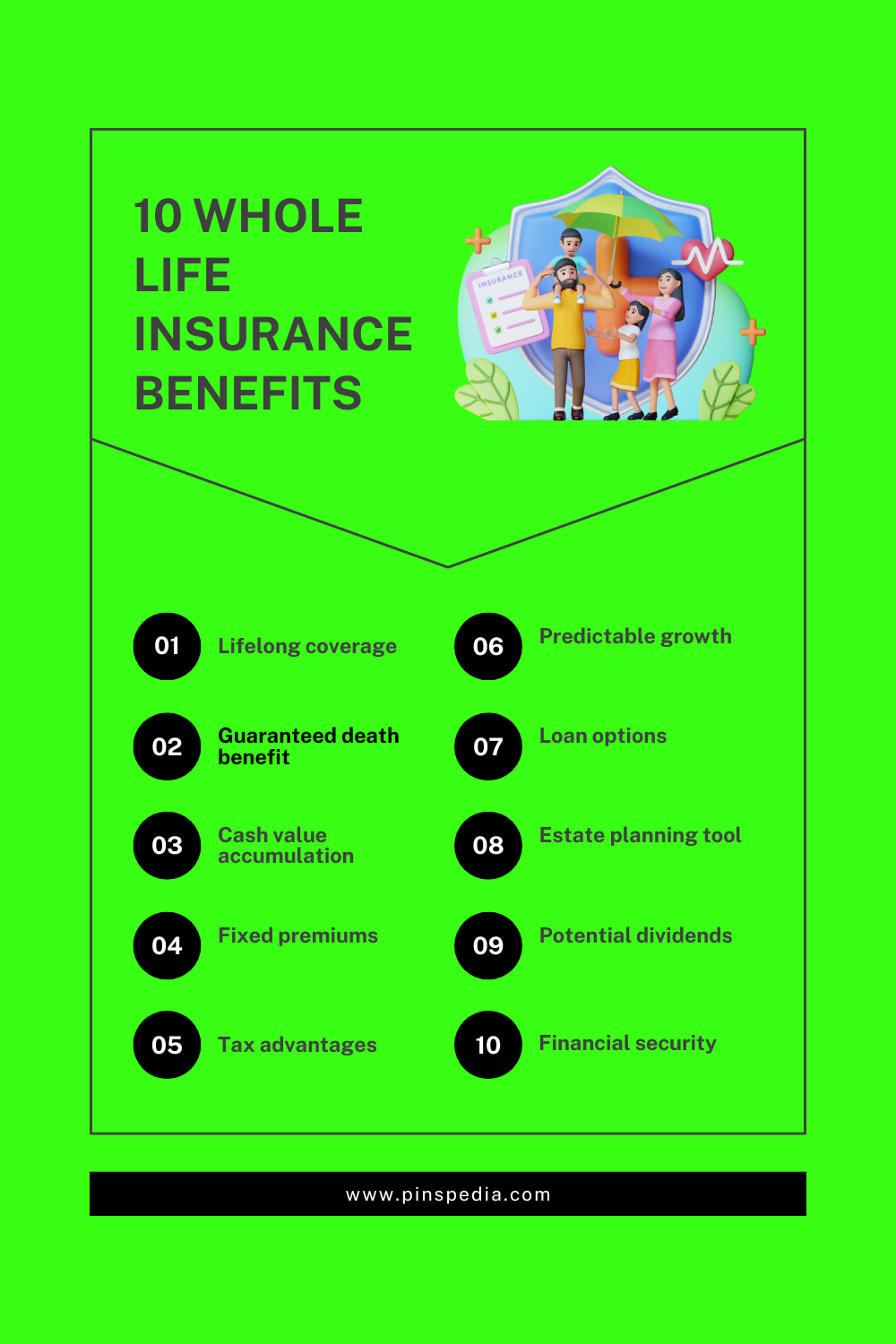

Whole Life Insurance Benefits

Whole life insurance is a popular choice for individuals seeking lifelong financial protection and savings. This type of permanent life insurance not only provides a death benefit but also includes a cash value component that grows over time. In this guide, we’ll explore the key benefits of whole life insurance in detail.

1. Lifelong Coverage

One of the most significant advantages of whole life insurance is that it provides coverage for your entire lifetime, as long as premiums are paid. Unlike term life insurance, which expires after a set period, whole life insurance ensures that your loved ones will receive a death benefit whenever you pass away. This lifelong protection offers peace of mind, knowing that your family will be financially secure regardless of when that may be.

2. Guaranteed Death Benefit

Whole life insurance comes with a guaranteed death benefit, meaning that your beneficiaries will receive a predetermined amount upon your death. This benefit is not subject to fluctuations in the market or your health status, providing certainty for your family’s financial future. The death benefit can help cover funeral costs, debts, and other expenses, ensuring that your loved ones are not left with financial burdens.

3. Cash Value Accumulation

A unique feature of whole life insurance is its cash value component. A portion of your premium payments contributes to a savings account that builds cash value over time. This cash value grows at a guaranteed interest rate and is tax-deferred, meaning you won’t pay taxes on it until you withdraw it. This accumulation can serve as a financial resource for various needs, such as emergencies, education expenses, or even retirement income.

4. Fixed Premiums

Whole life insurance policies come with fixed premiums, meaning that your payment amounts will remain consistent throughout the life of the policy. This stability makes budgeting easier and ensures that you won’t face unexpected premium increases as you age or if your health deteriorates. Knowing your premium will never change allows for better long-term financial planning.

5. Tax Advantages

Whole life insurance offers several tax benefits. The cash value of the policy grows on a tax-deferred basis, so you won’t owe taxes on the growth until you withdraw it. Additionally, the death benefit is generally paid out to beneficiaries tax-free, allowing them to receive the full amount without tax implications. This can be particularly advantageous in estate planning.

6. Predictable Growth

The cash value in a whole life insurance policy grows at a guaranteed rate set by the insurance company. This predictable growth provides a stable return on investment, making it an attractive option for those seeking a conservative savings strategy. While the returns may not be as high as other investment vehicles, the assurance of steady growth can be a valuable component of a balanced financial portfolio.

7. Loan Options

Another significant benefit of whole life insurance is the ability to borrow against the cash value. Policyholders can take out loans against their accumulated cash value, providing access to funds for emergencies or significant expenses without the need to liquidate other investments. While loans must be repaid with interest, they offer flexibility and liquidity that can be crucial in times of need. However, it’s essential to understand that any unpaid loans will reduce the death benefit.

8. Estate Planning Tool

Whole life insurance can be an effective tool for estate planning. It provides liquidity to cover estate taxes, debts, or other expenses that may arise upon your death. This ensures that your heirs receive the full death benefit without needing to sell assets or take on debt to settle your affairs. By including whole life insurance in your estate plan, you can protect your family’s financial future and leave a lasting legacy.

9. Potential Dividends

Many whole life insurance policies are eligible for dividends, which are a share of the insurer’s profits. While not guaranteed, dividends can provide additional cash value growth, reduce premium payments, or be taken as cash. Policyholders can use dividends to enhance their coverage, accumulate more cash value, or simply enjoy an additional financial resource. Understanding the potential for dividends can further improve the overall value of a whole life policy.

10. Financial Security

Overall, whole life insurance offers a combination of insurance protection and a savings component, making it a versatile financial tool. With lifelong coverage, guaranteed benefits, and the ability to build cash value, it provides financial security for individuals and their families. Whole life insurance can be an integral part of a comprehensive financial plan, helping to meet both short-term needs and long-term goals.

Conclusion

Whole life insurance presents numerous benefits that can contribute significantly to an individual’s financial well-being. From lifelong coverage and guaranteed death benefits to cash value accumulation and tax advantages, it offers a unique blend of security and savings. Understanding these benefits allows policyholders to make informed decisions about their financial futures and effectively plan for the needs of their families. Whether you are looking for a reliable safety net or a way to accumulate wealth over time, whole life insurance can be a valuable component of your financial strategy.