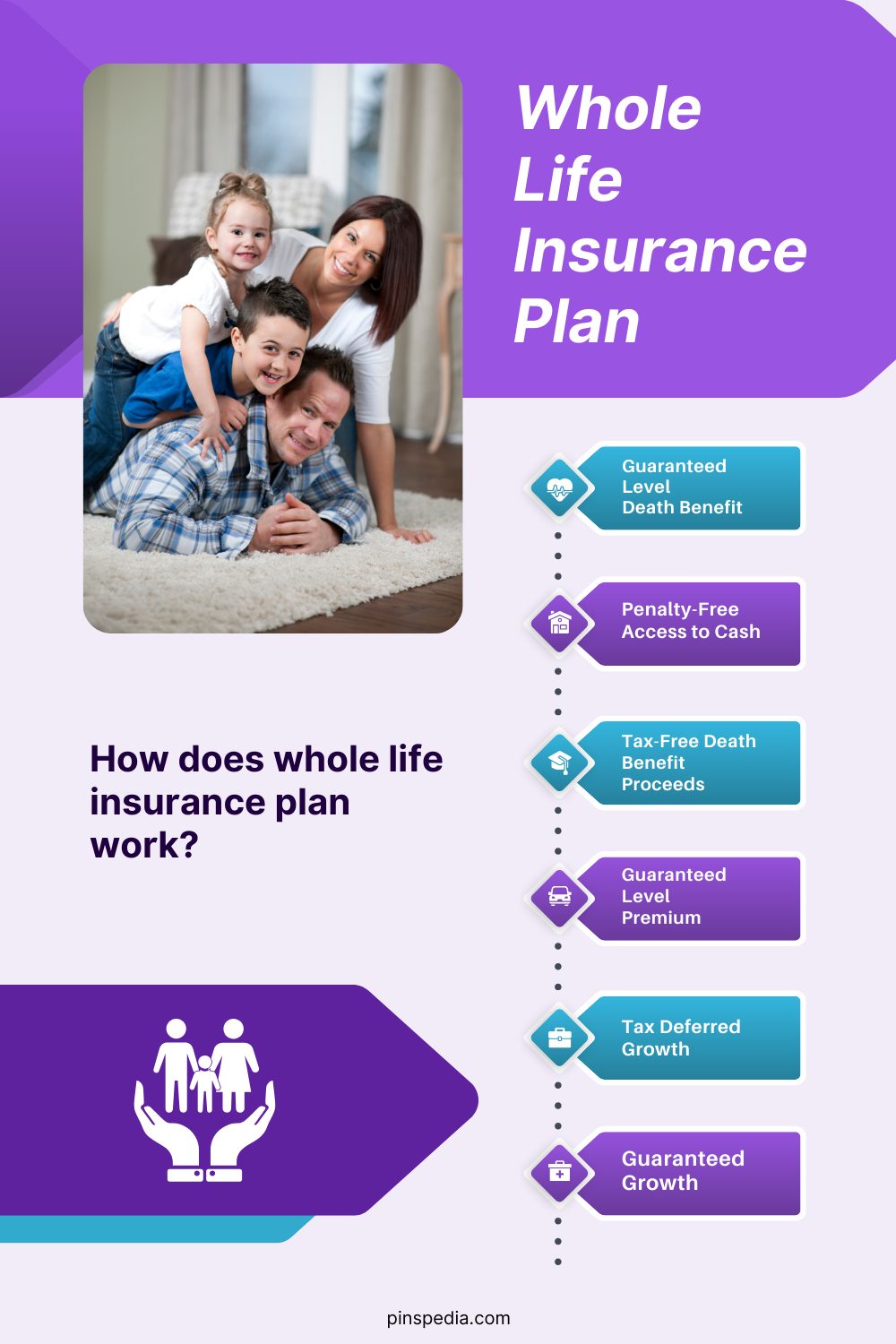

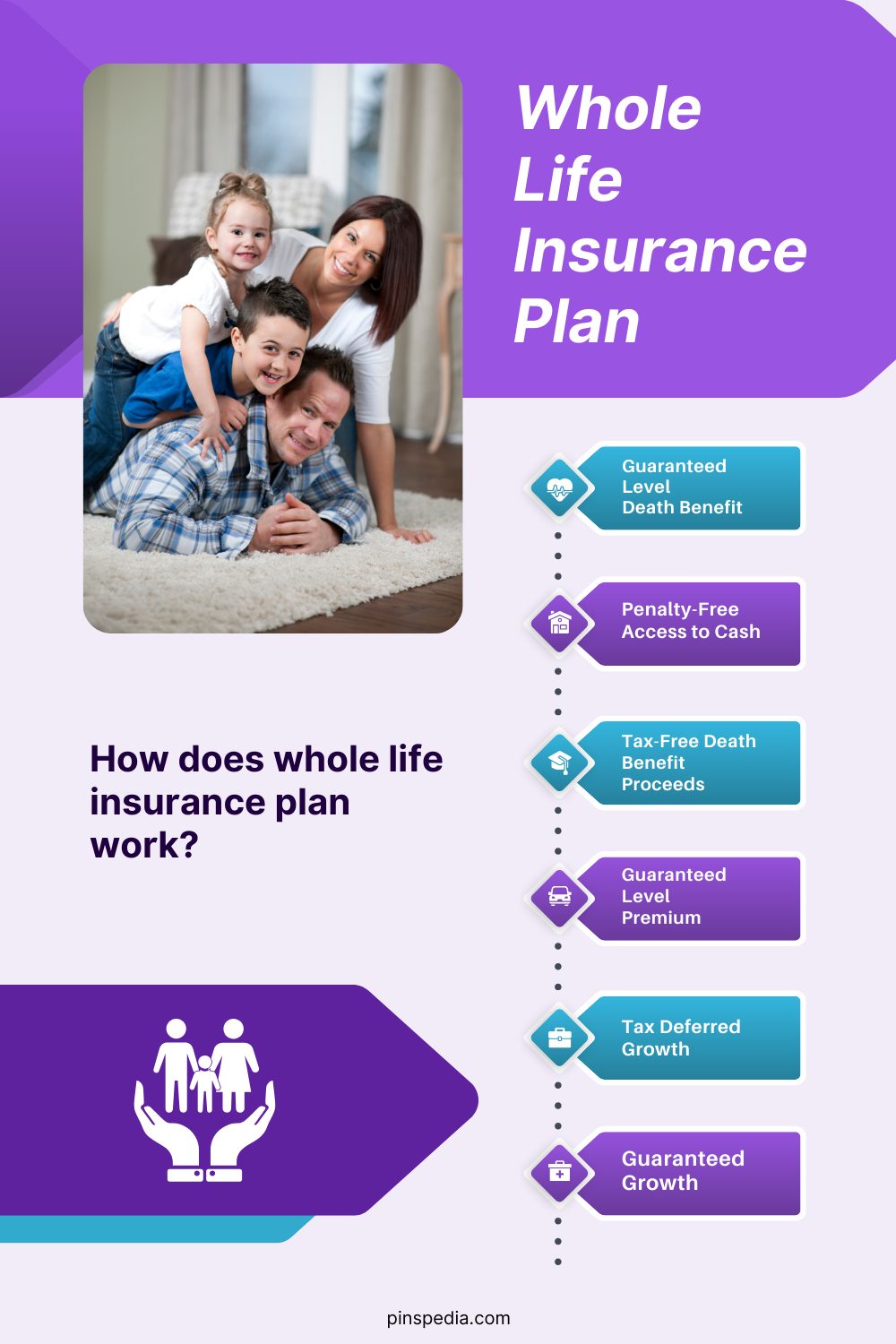

Whole Life Insurance Plan

Whole Life Insurance is a type of permanent life insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid. It also features a savings component known as the cash value, which can grow over time. This guide explains the key features, benefits, and how a whole life insurance plan works.

Key Components of Whole Life Insurance

Death Benefit

The death benefit is the payout the beneficiaries receive when the insured passes away. This amount is determined at the time the policy is purchased and remains guaranteed for the life of the policy, provided the premiums are paid.

Premiums

Premiums for whole life insurance are fixed and must be paid regularly (monthly, quarterly, or annually). Though the premiums may initially seem higher than term life insurance, they do not increase with age and remain consistent over time.

Cash Value

Whole life insurance includes a cash value component, which acts as a savings or investment feature. Part of the premium goes toward building this cash value, which grows at a guaranteed rate, tax-deferred. Over time, policyholders can borrow against the cash value, use it to pay premiums, or withdraw a portion of it. However, borrowing against it or withdrawing from it may reduce the death benefit.

How It Works

When you purchase a whole life insurance policy, you are entering a contract with the insurance company. You agree to pay premiums on a regular basis, and in exchange, the insurer guarantees a death benefit to your beneficiaries. The cash value component provides additional financial flexibility throughout the life of the policy.

Whole life insurance policies are designed to last for your entire life. As long as premiums are paid, the coverage does not expire, unlike term life insurance, which ends after a set period. The cash value component grows over time, often at a steady rate set by the insurer. Policyholders can access this cash value during their lifetime for various needs, but doing so may impact the overall death benefit.

Key Benefits

Lifelong Coverage

Whole life insurance provides permanent coverage, ensuring that your beneficiaries will receive a death benefit whenever you pass away, as long as you maintain premium payments.

Fixed Premiums

The premiums for whole life insurance do not increase over time, regardless of changes in your health or age. This allows for consistent, predictable payments.

Cash Value Growth

The cash value component builds over time and can serve as a source of funds for emergencies, large purchases, or retirement planning. Since it grows tax-deferred, you won’t pay taxes on the growth unless you withdraw more than the total amount paid in premiums.

Loan Opportunities

Policyholders can take out loans against their policy’s cash value, offering a source of liquidity when needed. Loans do accrue interest, and any unpaid loan balances will be deducted from the death benefit.

Considerations

While whole life insurance offers valuable benefits, it can be more expensive than term life insurance. For individuals seeking lifelong coverage with a savings component, this extra cost might be justified, but it’s important to assess whether the premium fits into your long-term budget.

Conclusion

Whole life insurance is a permanent life insurance product that not only provides lifelong protection but also includes a cash value feature that grows over time. By understanding its structure, including fixed premiums, the death benefit, and the cash value, you can decide if whole life insurance is the right choice for your long-term financial and insurance needs.