Whole Life Insurance Policy

Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid. It’s a policy that combines a death benefit with a cash value component, offering both protection and savings.

This guide breaks down how whole life insurance works, its key features, benefits, drawbacks, and considerations when choosing this type of policy.

Key Components of Whole Life Insurance

Whole life insurance consists of two main components:

Death Benefit

This is the guaranteed lump sum paid to beneficiaries upon the policyholder’s death. The death benefit remains fixed for the life of the policy, ensuring it won’t decrease over time.

Cash Value

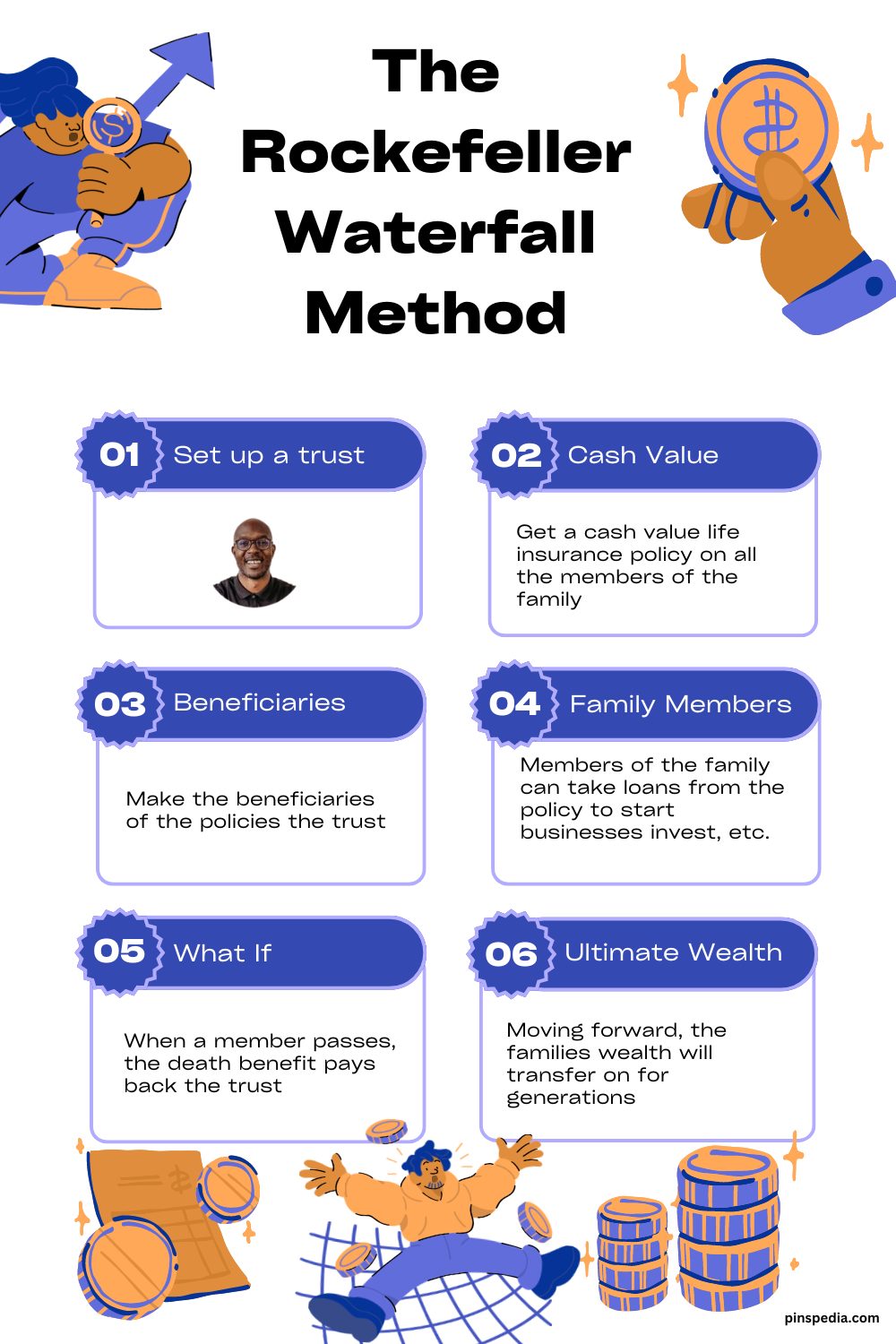

Whole life policies include a savings component known as “cash value.” A portion of your premiums goes into this cash value, which grows over time at a guaranteed rate. This cash value can be accessed through loans, withdrawals, or policy surrender, but any unpaid loans reduce the death benefit.

How Whole Life Insurance Works

Premium Payments: You pay fixed premiums throughout the life of the policy, making it predictable and stable. These premiums are higher than term life insurance, but they stay constant and won’t increase as you age.

Guaranteed Death Benefit: The policy guarantees a payout to your beneficiaries upon your death, as long as premiums have been paid, ensuring that the policy provides lifelong protection.

Cash Value Accumulation: Over time, part of your premium payment goes into building the cash value of the policy. This cash value grows tax-deferred and accumulates at a set interest rate determined by the insurance company.

Policy Loans and Withdrawals: You can borrow against your cash value, and it can also be used to pay premiums or even withdrawn. However, any loans or withdrawals reduce the death benefit unless they are repaid. The policyholder should carefully consider the consequences of accessing this cash value.

Types of Whole Life Insurance

There are different variations of whole life insurance policies to meet various financial goals:

Traditional Whole Life Insurance

This offers fixed premiums, a guaranteed death benefit, and a minimum guaranteed rate of return on the cash value. It is the most straightforward form of whole life insurance.

Universal Life Insurance

This policy provides more flexibility by allowing you to adjust the premiums and death benefit. The cash value grows based on interest rates, which may vary over time.

Variable Whole Life Insurance

This policy allows the cash value to be invested in sub-accounts like stocks, bonds, or mutual funds. While it offers the potential for higher returns, it also carries greater risk since the cash value is subject to market fluctuations.

Limited Payment Whole Life Insurance

With this type, you only pay premiums for a set number of years (such as 10, 20, or until age 65), but the coverage continues for life. This can be an attractive option for those who want to complete premium payments early while maintaining lifelong coverage.

Benefits of Whole Life Insurance

Lifelong Coverage: Whole life insurance offers permanent coverage that lasts a lifetime as long as you pay the premiums. Unlike term life insurance, it does not expire after a certain period.

Fixed Premiums: The premiums remain the same throughout the life of the policy, which offers financial stability and predictability over time.

Cash Value Growth: Whole life insurance policies build cash value over time at a guaranteed rate. This cash value can be used as a financial resource, allowing you to borrow against it or use it for other needs later in life.

Tax Benefits: The cash value grows on a tax-deferred basis, meaning you won’t pay taxes on the earnings unless you withdraw them. Additionally, the death benefit is usually paid out tax-free to your beneficiaries.

Estate Planning: Whole life insurance can be an excellent tool for estate planning. It provides liquidity to cover estate taxes, debts, or final expenses, ensuring your loved ones receive a financial safety net.

Drawbacks of Whole Life Insurance

Higher Premiums: Whole life insurance is more expensive than term life insurance due to the lifetime coverage and cash value feature. The higher cost can make it less affordable for individuals who only need temporary coverage.

Lower Returns on Cash Value: While the cash value grows steadily, the returns are often lower than what you might earn through other types of investments, such as stocks or mutual funds. The guaranteed growth is stable but conservative.

Complexity: Whole life insurance policies can be more complex compared to term life insurance, with more features to understand, such as cash value accumulation, policy loans, and dividend options.

When Whole Life Insurance Is the Right Choice

Whole life insurance is best suited for individuals who seek lifelong coverage and are interested in the savings feature of the policy. It can be an excellent option for:

- People who want to leave a financial legacy for their heirs.

- Those who have complex estate planning needs.

- Individuals who want to accumulate cash value over time and potentially borrow against it.

- Those who value the fixed premiums and guaranteed death benefit over a potentially lower-cost option like term life insurance.

When to Consider Alternatives

Whole life insurance may not be the best choice for everyone, especially for those looking for lower-cost coverage. If you only need coverage for a specific period (such as while paying off a mortgage or raising children), term life insurance is usually more affordable and straightforward.

Additionally, if you’re primarily focused on maximizing your investment returns, other financial products, such as investment accounts, may offer better growth potential than the cash value component of whole life insurance.

Final Thoughts

Whole life insurance offers a combination of lifelong protection and savings, making it a versatile financial tool for those with specific long-term goals. It provides peace of mind by ensuring that your loved ones are financially secure after your passing and offers the added benefit of accumulating cash value over time. However, its higher cost and lower returns compared to other investment options may make it less suitable for some individuals.

Before purchasing a whole life insurance policy, carefully consider your financial goals, long-term needs, and budget. Consulting with a financial advisor or insurance professional can help you determine whether whole life insurance is the right choice for you.