11 Reasons People Regret Buying Whole Life Insurance

When it comes to life insurance, many people assume that whole life insurance is a smart investment. However, a significant number of policyholders find themselves regretting their decision. In fact, studies show that an overwhelming 80% of whole life policies are surrendered before the policyholder’s death. This raises an important question: why do so many individuals, including professionals like physicians, end up dissatisfied with their choice of whole life insurance?

In this article, we will explore 11 key reasons why buying whole life insurance often leads to regret. From the complexity of cash value products to the aggressive sales tactics employed by some agents, there are numerous factors that contribute to the disillusionment many experience. While whole life insurance can serve a purpose for certain individuals who truly understand its nuances, it is crucial to scrutinize how these policies are marketed and the long-term implications they may have on your financial security. Let’s dive into the reasons behind this widespread regret and help you make an informed decision about your insurance needs.

11 Reasons People Regret Buying Whole Life Insurance

1. Complexity and Confusion

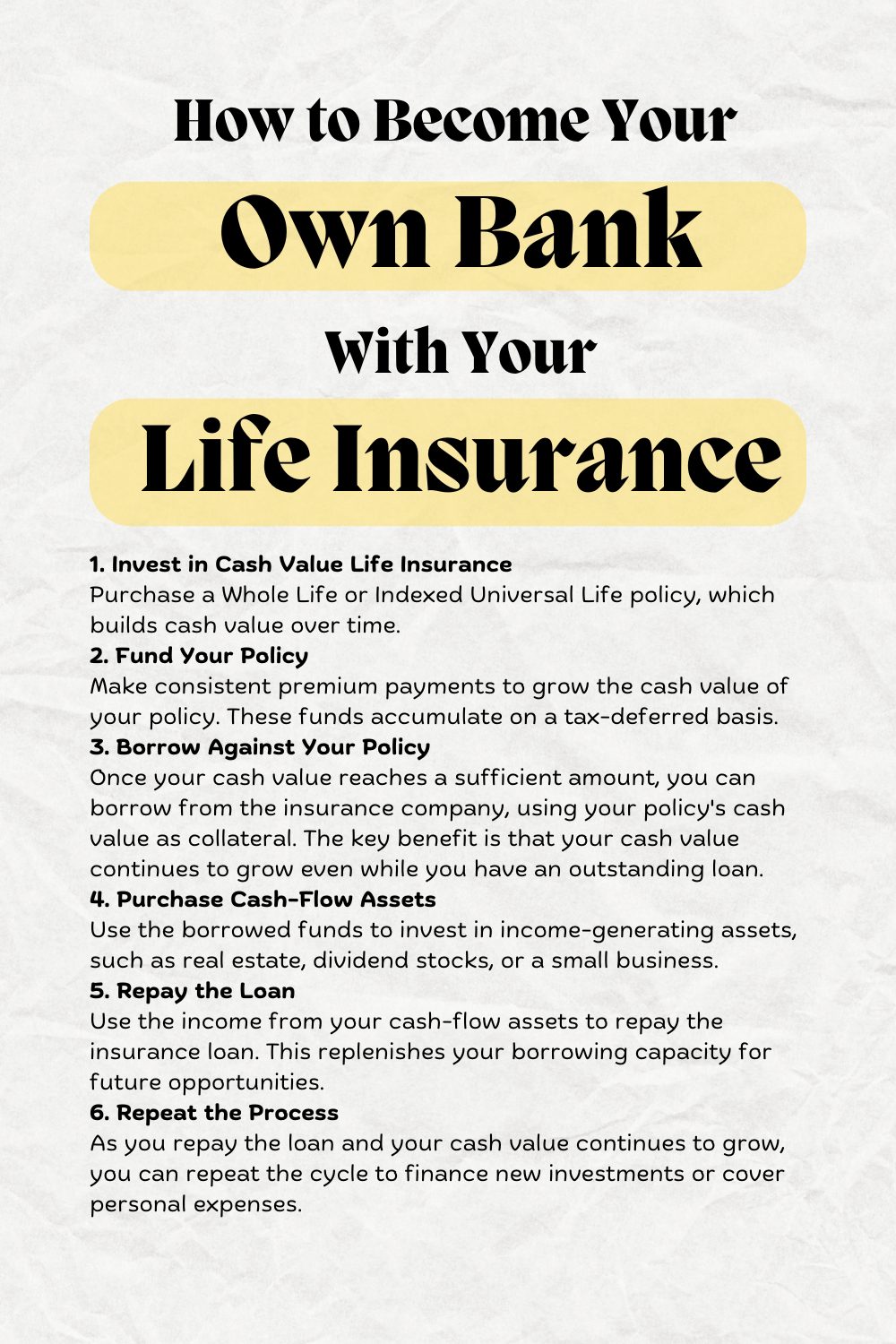

One of the most significant drawbacks of whole life insurance is its inherent complexity. Many policyholders struggle to fully understand the terms and mechanics of their policies, including how cash value accumulation, dividends, and loan provisions work. This confusion can lead to misguided expectations about returns and benefits. When faced with opaque policy details and intricate illustrations, many individuals may inadvertently make decisions based on incomplete information, ultimately regretting their choice to invest in whole life insurance. Clear and transparent financial education is essential to navigate such complex products effectively.

Reference: Financial Literacy and Consumer Protection Studies

2. Bad Advice

The regret of purchasing a whole life insurance policy often stems from the realization that individuals have received bad financial advice. Once you become financially literate, it’s not surprising to see that many went to an insurance agent with a clear conflict of interest expecting unbiased advice. Just as you wouldn’t ask a used car salesman whether you should buy a car, seeking financial guidance from someone who profits from your decision is problematic. This highlights the importance of finding true financial advisors who prioritize your best interests.

Reference: An Open Letter to Insurance Agents

3. Better Use for Your Money

Most doctors, especially young doctors, have far better uses for their money than investing in whole life insurance. After years of deferred gratification, the cash flow needs of a graduating resident often outweigh available funds. With significant student loans to repay, house down payments to save for, and various insurance premiums to consider—such as disability and term life insurance—it’s clear that these professionals need to focus on prioritizing their financial health rather than locking funds in whole life policies.

Reference: An Open Letter to Insurance Agents

4. Life Changed

Life is unpredictable, and it changes far more frequently than anticipated. If you buy a whole life policy and later decide to work part-time or take a sabbatical, you may find it difficult to adjust your financial commitments. You can reduce spending in various areas, but you can’t cut back on that whole life insurance premium. This creates a substantial fixed expense at a time when your income may be decreasing. Such rigid financial commitments can become burdensome as your life circumstances evolve.

Reference: An Open Letter to Insurance Agents

5. Unnecessary Insurance

As individuals gain financial literacy, they often realize that insurance, on average, is a bad deal. This is a mathematical certainty; insurance companies collect premiums to cover expenses and pay out claims, meaning the average payout must be less than the average premium. Therefore, buying whole life insurance often results in paying for coverage that may not be necessary. For instance, purchasing a whole life policy just to secure a long-term care rider is a classic example of buying unnecessary insurance.

Reference: Is Whole Life Insurance a Scam?

6. Asset Protection

A significant portion of the cash value in a whole life insurance policy is protected from creditors in many states. However, if you live in states like California, Colorado, or Connecticut, which offer limited or no creditor protection (defined as less than $250,000), you might regret your decision if you primarily sought asset protection benefits. Understanding your state’s laws is crucial, as many individuals purchase these policies without realizing the limitations on their protective features.

Reference: An Open Letter to Insurance Agents

7. Tax Advantages Oversold

A common sales tactic for whole life insurance is to emphasize its purported tax advantages, claiming “tax-free retirement income” and “tax-free to your heirs.” While these statements contain elements of truth, they can be misleading. For example, the tax-protected growth of dividends or interest isn’t unique to whole life policies; you can find similar benefits in **401(k)**s, Roth IRAs, and even your home. Moreover, while you can borrow against the cash value tax-free, it’s important to remember that you’re not avoiding interest payments. The tax-free death benefit is also comparable to inheritances from other assets, which generally receive a step-up in basis. Ultimately, once policyholders recognize the limitations of these claimed tax benefits, they often regret their purchase.

Reference: Is Whole Life Insurance a Scam?

8. Negative Returns

Experiencing negative returns is common in the initial years following the purchase of a whole life insurance policy. This isn’t a flaw; it’s a built-in feature. Typically, the cash value will initially be less than the total premiums paid, primarily due to the significant commissions paid to agents and costs associated with the death benefit. It’s not unusual to be “underwater” for five to fifteen years after purchasing, which can lead to disappointment when policyholders realize they’re not receiving the investment returns they expected.

Reference: An Open Letter to Insurance Agents

9. Low Returns

Even when the policy finally breaks even, many investors are often disillusioned by the low returns on their cash value. Many mistakenly equate the dividend rate with the actual rate of return, which is significantly lower—typically around 2% annually, often lagging behind the rate of inflation. While agents may project higher returns, the reality is that actual returns over the lifetime of the policy are often disappointing, leading to further regret among policyholders.

Reference: An Open Letter to Insurance Agents

10. Cost of Insurance Rises

While whole life insurance features guaranteed premiums, this issue primarily concerns its variant, universal life insurance. With universal life, the cost of insurance escalates each year, similar to annually renewable term life insurance. In the beginning, policyholders may enjoy lower costs, allowing cash value to build up. However, as insurance costs rise, they can consume premiums and erode cash value, forcing policyholders to pay increasingly larger premiums to keep the policy active. This can transform what was intended as a financial asset into an unexpected financial burden.

Reference: Should You Keep Whole Life Insurance Policy and How to Cancel

11. Non-Qualified Investments Aren’t That Bad

Many individuals are led to purchase whole life insurance due to a lack of knowledge about non-qualified investments. After maxing out their 401(k), they may feel they have no alternative investment options. However, they can actually explore tax-efficient avenues like total market index funds, municipal bonds, and equity real estate. These non-qualified accounts provide significant advantages, such as lower capital gains tax rates and tax-loss harvesting opportunities. This highlights a common misconception: that outside of retirement accounts, investment options are limited.

Reference: An Open Letter to Insurance Agents